(Source: Merlea Macro Matters)

Summary

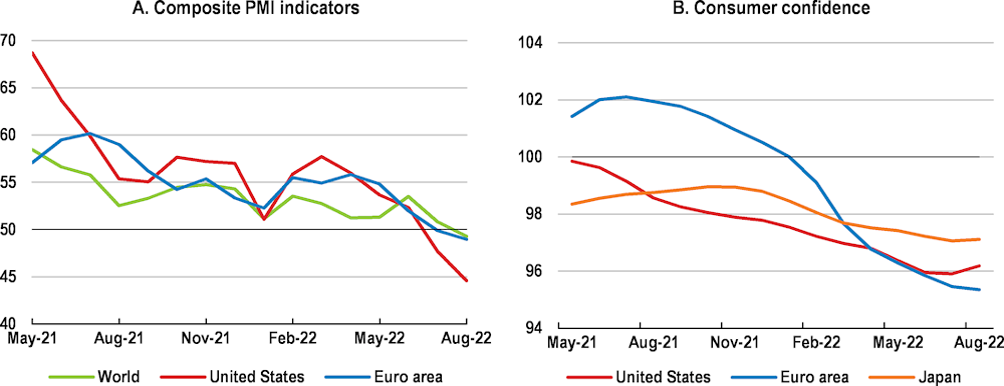

Global GDP stagnated in the second quarter of 2022 and output declined in the G20 economies. While it is likely that growth in the third quarter has been positive, helped by a pick-up in China, several indicators have taken a turn for the worse, and the global growth outlook has darkened.

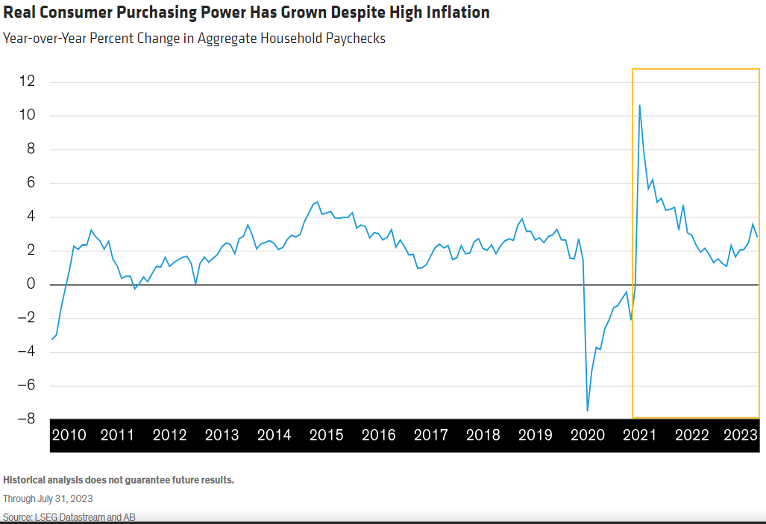

Survey-based indicators are particularly weak. Business survey indicators point to stagnating output in many economies while consumer confidence has fallen to strikingly low levels in most advanced economies. The OECD Composite Leading Indicator for the global economies is also now at the lowest level since the global financial crisis, barring a brief drop at the beginning of 2020. With nominal wage growth failing to keep pace with inflation, household real disposable incomes have declined in many Global economies, curbing private consumption growth.

Financial conditions have tightened as central banks have responded increasingly vigorously to above-target inflation, pushing up market-based measures of real interest rates. Equity markets in much of the world have fallen sharply this year, nominal bond yields have risen, the US dollar has appreciated significantly, and risk appetite has diminished. Corporate bond spreads have risen, particularly in Europe, and capital outflows from emerging-market economies have intensified.

In the United States, the differential between ten-year and two-year government bond yields remains negative, a phenomenon often followed in the past by cyclical downturns; yield curves have tilted in a similar way in some other advanced economies, especially the United Kingdom.

Labour market conditions are tight almost everywhere. In many developed economies, unemployment rates are at their lowest levels of the past 20 years, while the ratio of jobseekers to vacancies remains historically low. Nonetheless, the pace of job growth in North America and Europe has slowed, vacancies have begun to decline in some countries, and the reduction in the unemployment rate appears to have bottomed out or even reversed in some countries.

Inflationary pressures have become increasingly broad-based, with higher energy, transportation and other costs being passed through into prices. Wage and unit labour cost growth has strengthened in many countries, particularly the United States, Canada, and the United Kingdom, putting upward pressure on a wide range of goods and services prices. There has yet to be strong evidence of an acceleration of nominal wages in the euro area, in part due to the relatively low incidence of automatic wage indexation but, with high headline inflation and a tight labour market, wage growth is likely to strengthen.

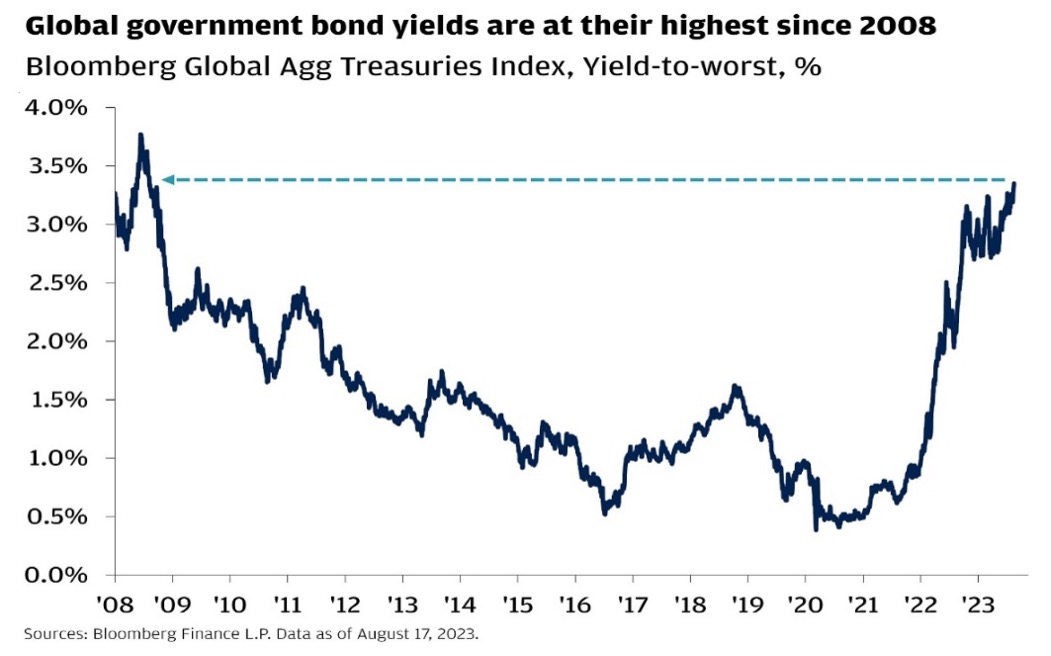

Bonds

The rise in long-term interest rates around the developed world over the past month is at odds with slowing global growth and falling inflation. Prior to the pandemic, long-term rates usually fell under those conditions. In our view, the sharp rise in real interest rates reflects the difficulty that the U.S. and other developed economies are having funding the unprecedented peace-time deficits that have followed the pandemic.

The recent downgrade of U.S. government debt by Fitch noted this deteriorating long-term outlook. Partly it reflects the sheer magnitude of the Treasury supply flooding the market as the deficit has doubled from 4% to 8% of gross domestic product (GDP) over the past year.

Just as important, the buyers who absorbed most of the debt in the past have pulled back. Demand is falling while supply is exploding, forcing rates higher.

For example, the Fed, which purchased trillions of dollars in recent years during quantitative easing, has turned from being the biggest buyer to being a net seller as it runs down its balance sheet with quantitative tightening. Even as inflation heads towards the Federal Reserve’s 2% target rate, the 10yr treasury bond is likely to remain elevated at around 4.25%-4.50%. It is entirely plausible that US bond yields will continue to extend higher in coming months into a new trading range.

With costs increasing and a key source of revenue declining, the US Treasury will have to rely on borrowing to finance federal spending. But with the Fed implementing quantitative tightening (where T-Bill and bond in the portfolio are allowed to mature and roll off), the US Treasury will have to increasingly rely on issuing even more bonds and T bills to fund the gap. This will potentially ratchet bond yields up even further. We believe this will be a bearish technical setup for the US bond markets – with yields across the curve on the cusp of another leg higher.

Bank of Japan Governor Kazuo Ueda floated the possibility of ending Japan’s negative interest-rate policy, pushing 10-year bond yields up to the highest level since 2014. With the yield extending higher to 0.7%, scope is now raised for further upside towards 1.5%. Japanese investors are major holders of foreign bonds, thanks in large part to years of ultra-low interest rates at home. Some analysts are concerned that a rise in Japanese rates could draw money back to Japan and out of Global bond markets.

Other big buyers are pulling back as well. Foreign central banks concerned about the security of dollar reserves after the confiscation of Russia’s have naturally been diversifying away from Treasurys.

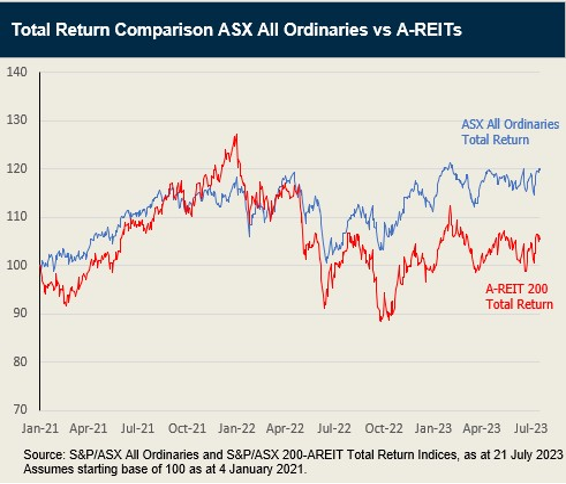

Listed Property

REITs can be a powerful way to diversify your portfolio as well as bring in a stable income stream. The price of real estate generally rises along with inflation. Thus, these types of investment vehicles may be better hedges against inflation than other types of investments. There’s no doubt, however, that the pandemic has transformed rental housing, offices, retail, and other sectors, and that market trends will play out differently across countries and regions. For example, office buildings in central business districts in cities such as San Francisco are challenged by remote work trends. However, enthusiasm for working from home has been less pronounced in markets such as London, as well as Singapore and other Asian capitals, particularly for individuals going to high-end, sustainable offices in alluring locations.

Rising interest rates impact REITs in several ways. Directly, interest expenses can go up as the interest rates on variable-coupon debt increases and as fixed-rate debt rolls over. There’s also an impact on the translation environment, as sellers are generally slow to lower asking prices to accommodate higher borrowing costs. Many won’t until there is financial distress, effectively forcing them to sell. These are dislocations that can linger over a long period, but they aren’t new or unusual, and financially strong REITs with good management teams can navigate them (for example, by pushing through higher rental rates).

The other big problem with interest rates is that REITs are income vehicles that compete for investor attention with other income options. With rates notably higher, investors have other options, including safe, government-backed CDs. The drop in REIT prices is, to some degree, increasing dividend yields to better compete. This isn’t new either, though there is little that a REIT can do about what amounts to investor sentiment.

Whilst cap rates and asset values are finally starting to move, reflecting the higher cost of capital and emerging transactional evidence, we believe REIT valuations are at fair value, although in the short term there could be ongoing risk to NTA, balance sheet gearing, and investor sentiment. The greater expected cap rate movements are arguably already reflected in share prices, with most REITs trading at a 20%-30% discount to their book value. The key to closing the gap is either bond yields moving down and/or REITs achieving earnings growth to offset the rise in the cost of capital and cap rate expansions.

Negative views of REITs are coloured by the competitive yields (about 5%) paid by some other income investments, such as money markets. But these have no potential for growth. Sure, unlike money markets, REITs pose a risk to capital, but these risks can be managed with judicious REIT selection. And while investors wait for shares to rise in value, they collect healthy dividends.

Patience will be important, as supply and demand will ultimately determine the long-term value of real estate. Land-use restrictions and high construction costs will reduce supply more than in any previous cycle, underpinning real estate values over the long term.

Australian Equities

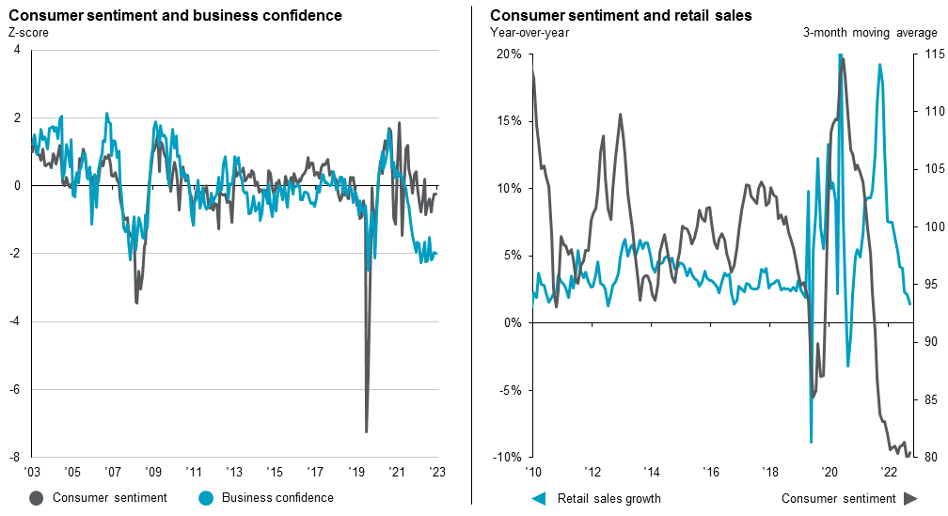

In the reserve bank’s latest update on the economy, it highlighted that Australia’s economic output per person is forecast to shrink in the second half of 2023 as higher interest rates and the rising cost of living combine to pummel households. Wage increases have remained steady at an annual rate of about 3.7% across the first six months of this year and will quicken modestly to about 4.1% by the year’s end. While inflation pressures were generally easing since a peak last December, some components of the consumer price index are predicted to rise, such as for renters.

“Rent inflation is forecast to increase further over the period ahead as rental vacancy rates remain low, and as housing supply responds with a lag to population growth,” the RBA said, adding, “there remains a high degree of uncertainty around the speed and extent of the decline in inflation expected in the period ahead.” The RBA has warned that the inflation target of 2% to 3% will become harder to maintain in the years ahead, as the global economy grapples with the unprecedented challenges of climate change and supply shocks.

This month’s inflation report was softer than expected as prices only rose by 4.9% y/y and the core CPI reading, or the trimmed mean, was 5.6% y/y. These are significant improvements from the peak in inflation back in December 2022. However, the RBA is unlikely to let up on its hawkish bias for now, even as it continues its conditional hold on the policy rate at 4.1%. The RBA has decided to leave the cash rate on hold for the third month in a row, giving borrowers breathing room during a cost-of-living crisis and a rise in mortgage stress. Some 1.5 million people, or just shy of one-third of all home loan borrowers, are at risk of mortgage stress because of the RBA’s run of rate hikes that has taken the cash rate from an historic low of .1% to 4.1%.

A growing expectation that interests rates have peaked, or are near a peak, should help to lift consumer sentiment from the recession-like lows that have persisted over the past nine months. Consumer confidence and housing activity go hand in hand. Generally, when sentiment is low, home sales are low and vice versa; so, any lift in sentiment is likely to be accompanied by a rise in active buyers and sellers.

August earnings resulted in dulled market performance. The three standout features of the August earnings season were the resilience of the consumer, the cost pressures facing corporates, and the ability for companies to manage higher financing costs. Companies varied in how they dealt with these features. But with the resilience of the consumer to be tested in the months ahead, the ability to deal with higher rates will be a key feature of corporate profitability.

Global markets

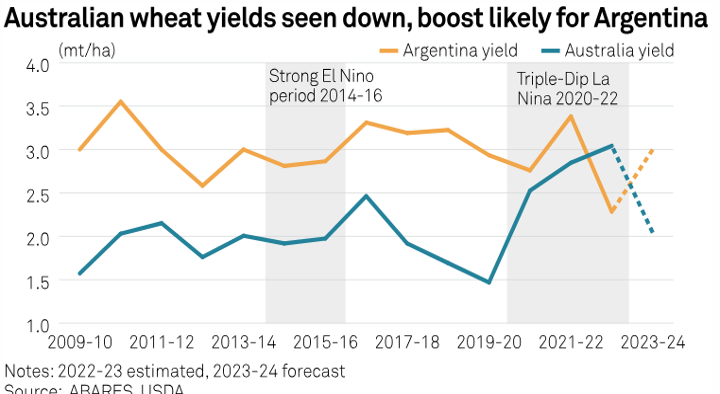

Global economic growth is likely to moderate in the second half of 2023, while inflation looks set to cool off. Global core inflation will remain high at above 3% through to 2024. We do not think inflation is going to come back down to central bank comfort zones although there’s a decline going on. Getting inflation back below 3% in the U.S. or the euro area this year in an environment where supply has been damaged in a more lasting way and inflation psychology has shifted. Adding to this the impact of La Nina, but also its potential to disrupt the falling inflation narrative. Food prices and soft ag commodities could be at risk of reasserting to the topside and arresting the decline of inflation. This year we have also highlighted the risks of a second wave of inflation. Persistently high inflation will keep the pressure on central banks, meaning further tightening could well lie ahead.

America

After demonstrating some surprising resilience in the wake of 525 basis points of rate hikes, the US economy has shown some early indications that momentum is waning. The latest nonfarm payroll data revealed that the labour market is slowly coming into a better balance. The pace of hiring has moderated, labour force participation is on the rise, and the ratio of job openings to unemployed people has retreated to a two-year low.

All this data is good news for those who share the US Federal Reserve’s view of an unprecedented scenario in which disinflation occurs without a recession. The US unemployment rate rose slightly in August, from 3.5% to 3.8%, driven up by a higher participation rate but it remains historically low. Job data has reassured the Federal Reserve and its chairman, Jerome Powell, whose tone was balanced at the Jackson Hole seminar in late August between the risks “of doing too much or not enough”, thus suggesting that interest rates will remain at 5.5% at the coming meetings.

We reiterate our cautious take on what comes next, from the point of view of both business investment (hit by monetary tightening and unresolved regional bank issues) and consumption, as the current pace of household spending (with the savings rate once again under 4%) is unsustainable in a context in which employment is likely to continue slowing.

While welcome news for the Federal Reserve, the latest data on inflation has been more mixed. At 4.3% y/y, the Federal Reserve’s preferred inflation gauge (the core personal consumption expenditures price index) remains over double the central bank’s 2% objective – while “supercore” inflation (core services ex-housing) pushed up to 4.7% y/y, its highest rate since the beginning of this year. The apparent softening in the labour market gave the Federal Reserve room to pause this month. However, policymakers will need to see further evidence of cooling on both the labour market and inflation fronts over the coming months to stay on the sidelines.

And yet, hiding behind these encouraging figures is a double reality. While figures on US consumer spending (two thirds of GDP) look as robust as ever, things are looking tougher for the most modest households, especially as prices have risen steeply over the past year.

This pressure on needier consumers is also seen in their increased use of revolving credit facilities now that they have used up most of their excess savings. Meanwhile, payment defaults are accelerating, and US banks toughen their credit conditions. The next consumer spending figures will therefore be key in assessing the extent of the current slowdown.

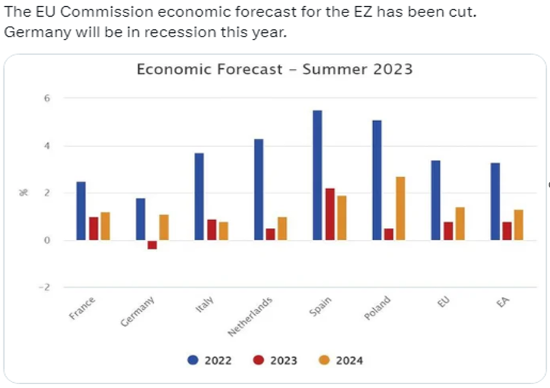

Europe

Latest data confirm that economic activity in the EU was subdued in the first half of 2023 on the back of the formidable shocks that the EU has endured. Weakness in domestic demand, in particular consumption, shows that high and still increasing consumer prices for most goods and services are taking a heavier toll than expected. A key source of weakness has been Germany, whose manufacturing- and export-oriented economy has been hit by higher energy prices and slowing demand in China, a key trade partner.

This is despite an exceptionally strong labour market, which has seen record low unemployment rates, continued expansion of employment, and rising wages. Meanwhile, the sharp slowdown in the provision of bank credit to the economy shows that monetary policy tightening is working its way through the economy.

Survey indicators now point to slowing economic activity in the summer and the months ahead, with continued weakness in industry and fading momentum in services, despite a strong tourism season in many parts of Europe.

The global economy has fared somewhat better than anticipated in the first half of the year, despite a weak performance in China. However, the outlook for global growth and trade remains broadly unchanged compared to spring, implying that the EU economy cannot count on strong support from external demand.

Overall, the weaker growth momentum in the EU is expected to extend to 2024, and the impact of tight monetary policy is set to continue restraining economic activity. However, a mild rebound in growth is projected next year, as inflation keeps easing, the labour market remains robust, and real incomes gradually recover.

United Kingdom

Despite a strong June GDP rebound, the UK faces a challenging period as corporate insolvencies jump, and productivity remains anaemic. The UK economy grew by 0.2% in the second quarter of 2023, up slightly from growth of 0.1% in the previous quarter, according to the latest official figures from the Office for National Statistics (ONS). Government measures to boost the UK’s growth potential also include agreements to restore a smooth flow of trade within the UK internal market known as the “Windsor Framework,” in addition to an expansion in the range of businesses able to benefit from them. IMF officials have stated that a more measured approach to reviewing retained EU laws “will help reduce Brexit-related uncertainty (while) . . . enhanced childcare support and tax relief on investment in plant and machinery introduced in the spring budget should support labour participation and business investment, respectively.”

Outflows have recently slowed in the United Kingdom as investors have been signalling a return of some optimism for the economy’s enticingly cheap investment prospects. Falling energy and stabilising food prices helped cool Britain’s annualised consumer price inflation rate from June’s 7.9% to July’s 6.8%. While the UK’s inflation rate is still far higher than the Bank of England’s 2% target, we believe its recent downturn could suggest a turning point.

Taken together, these points make for an appealing case for investors to hold UK companies that seem to be signalling good prospects and perhaps a recognition of undervalued stocks amid a slew of buybacks across several sectors to boost shareholder returns.

Japan

Reflationary dynamics are taking hold in Japan, helping support our belief that the post-reopening recovery will continue. Rising nominal GDP should provide a favourable backdrop for capex and wage growth. Household consumption has yet to fully recover from pandemic lockdowns and remains below pre-pandemic levels. While higher inflation has weighed on real income since early 2022, consumer confidence has improved sharply since the start of the year, helped by rising expectations of higher wages. This year’s spring annual labour wage negotiations resulted in a 2.1% growth in base wages, the fastest in three decades.

This improvement, together with a recent hike in the minimum wage, will likely sustain the recovery trend in wages and consumer spending. As economic slack continues to tighten, price pressures are building in Japan. The key indicator the Bank of Japan (BoJ) uses, core inflation excluding fresh food and energy, has exceeded 4% year-over-year (y/y) in the past few months, mainly driven by services rather than imported goods. Services inflation alone in July reached 2.0% y/y for almost the first time in more than 30 years.

We expect Japan’s inflation to remain elevated due to this broadening of services inflation and gradual disinflation in goods prices. Goods inflation will likely be slow to come down, even as import cost pressures ease, mainly because Japanese corporations are late in passing on their higher costs, which began rising last year. Investors’ focus will continue to be on this dynamic: To what extent can companies in the service sector pass on higher wages in their pricing, leading to a virtuous cycle of rising wages and prices? We expect to see more of this, amid solid consumption demand.

The BoJ adjusted its yield-curve-control (YCC) in July, effectively increasing the 10-year Japanese government bond’s permissible trading ceiling to 1%, from 0.5%. The central bank’s explanation for the change struck a dovish tone (a desire to improve market functionality and reduce market volatility), suggesting it was not yet confident it would achieve its 2% inflation target in a sustainable manner.

The BoJ has more work to do in normalising monetary policy, now that as Japan has decidedly emerged from the deflation that first necessitated the ultra-loose monetary policy. However, the hurdle is higher for more substantial policy tightening moves: The BoJ will require further improvement in the underlying inflation outlook. Specifically, the BoJ will need to see more persistent wage improvement, rather than just one good spring wage negotiation. Our base case expects the BoJ to stay on hold for the rest of this year and to exit negative interest rates in 2024.

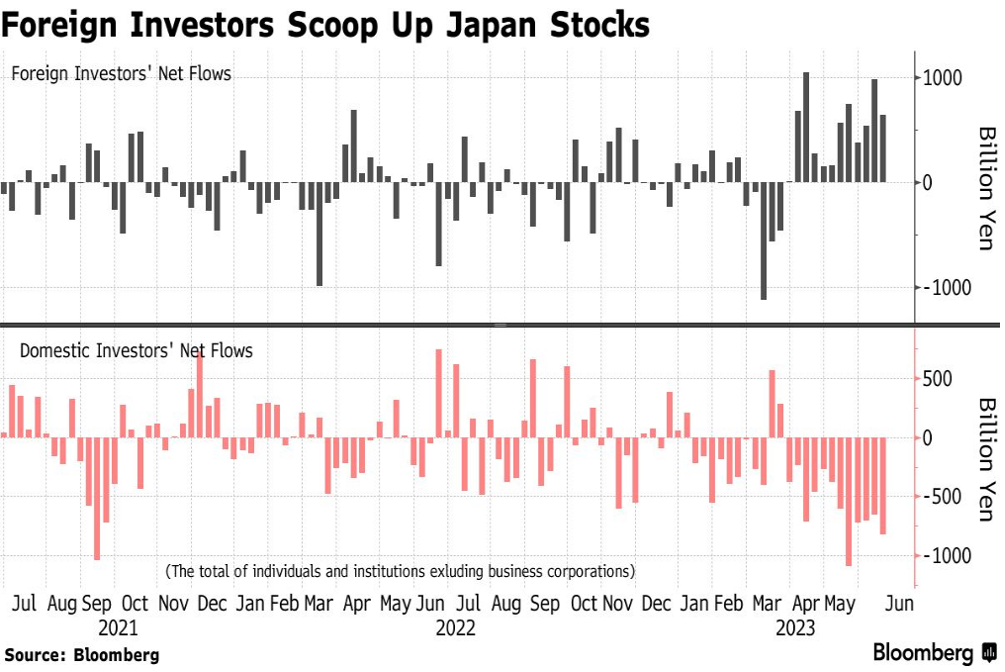

Historically, Japanese companies have maintained high cash positions on their balance sheets. But recent Tokyo Stock Exchange reforms created incentives to improve shareholder returns by better managing the cost of capital. The reforms have spurred a series of restructuring and buyback announcements aimed at improving ROE, further bolstering the case for owning Japanese equities.

Foreign investors haven’t missed these developments and have flocked to the Japanese equity market. But we don’t consider the market overcrowded. Global equity fund positioning remains slightly underweight Japan, leaving the door open for further inflow that could drive outperformance.

China

Public confidence within China as measured by Ipsos, a global market research agency, remains above the past six-year average. Household revenues are on the rise, growing approximately by 8% YoY, enticing people to repay their mortgages. PMI indicators have been rising lately, the average of the official and the Caixin manufacturing PMIs hitting its highest level for the past five months (50.4, which indicates a slight acceleration of the economy).

This is not to say that China does not have issues. It is going through a systemic and self-inflicted property crisis that is having profound repercussions throughout the entire economy. It is such that it will probably force the government to embark in fiscal reforms as the current tax revenue model that relies to a large extent on land sales is broken.

After two years of seeing sales collapse and scores of private property developers default one after the other without taking much action to stop the bloodbath and restore confidence, the government has finally acted in August by announcing unprecedented structural reforms that have the potential to gradually change the course of the sector, and by repercussion of the economy.

The first reform relates to minimum downpayment. Going forward, the minimum downpayment will be 20% for a first flat and 30% for a second flat across the entire country, with the same rules applying to the largest Tier 1 and to the smallest Tier 5 cities.

The second reform is the fact that a borrower who has entirely repaid a mortgage and is applying for a new one to buy a new flat (which would typically be the case of a couple wishing to upgrade with the arrival of a child) would be considered as a first-time buyer all over again.

The third reform allows borrowers to renegotiate their existing mortgages with their bank. Until now, it was illegal. This is even more relevant that mortgage rates were cut several times over the past months. PBoC, the Chinese central bank, has given instructions to all banks to accommodate such requests. PBoC estimates that the cost to borrowers will be reduced by approximately 80bps for those who will seek to renegotiate their current mortgage. These are structural changes that align China with practices around the world.

Another structural issue the government needs to tackle is youth unemployment that keeps on hitting new highs. This is the consequence of three years of zero-Covid policy and lockdowns, as well as the consequence of the impact of the government crackdown against the internet companies that used to recruit hundreds of thousands of new graduates every year.

The increase in the number of new college and university graduates was 1.7m in June 2022, an all-time high, to reach a total of 10.8m. This number rose further by 0.8m in June 2023, to reach 11.6m. Going forward, the increase is expected to drop to 0.4m in June 2024 and the total number of graduates to plateau around 12m in the coming years as the impact of Covid-related policies subside. Meanwhile, the crackdown against the platform economy is over.

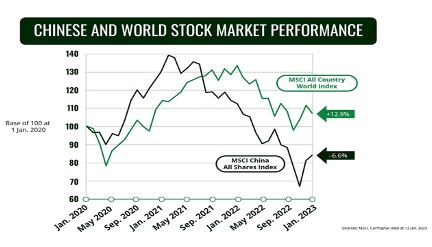

So far this year market participants were clearly disappointed by the lack of forceful decisions made by the Chinese government. Markets always prefer bazooka-type of decisions that have an immediate impact. As investors started realising that it would not happen, markets corrected past the initial reopening euphoria we enjoyed at the start of the year. Even though the performance of Chinese equities, as well as of Asian market indices that are heavily tilted towards China, have been disappointing so far this year. For sure the economic situation of China will not turn around overnight, but as explained above there are signs that the trough might be behind us.

Emerging Markets

The BRICS summit in South Africa in August announced the expansion of the group to include potentially six new members in early 2024. The BRICS+2 grouping continues to focus on building a multipolar world and giving a voice to developing countries, also known as the Global South. The inclusion of three Middle Eastern countries has implications for global energy security as it raises the group’s share of global oil reserves to 41%. It will also increase the relevance of the New Development Bank, the BRICS multilateral lending organization which has loans and investments of US$21 billion.

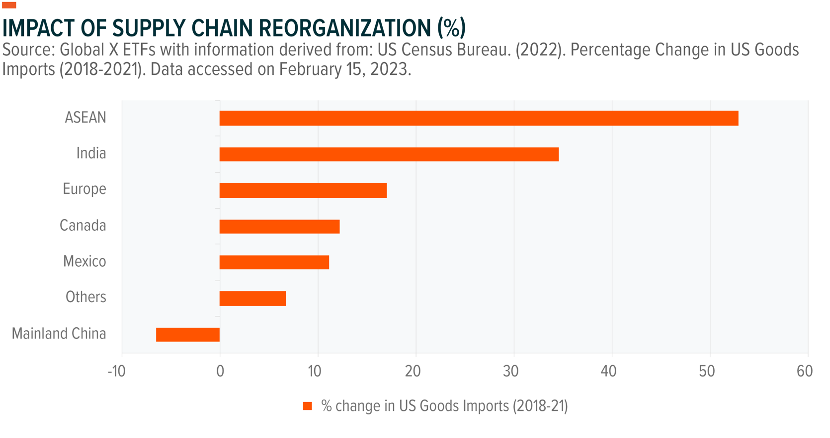

Nearshoring: Nearshoring supply chains has gained steam on the back of the U.S.-China trade war, COVID-19 supply-chain crisis, and increasing production costs. In turn, China’s export dominance is ebbing, creating opportunities for other emerging market countries to fill the gap, including Mexico, India, and Southeast Asian nations. Furthermore, given the scale needed to move supply chains, this trend could be a relevant driver of capital flows for the next decade.

Despite the potential challenges of a slowing global economy, we remain optimistic about the outlook for emerging markets, particularly in Asia. China’s reopening rally undershot first half hopes, but valuations remain attractive, and we see green shoots across specific areas. India and Indonesia offer especially attractive medium- and long-term growth prospects. We anticipate that regional growth will continue into 2024, driven by a decline in real interest rates to propel further domestic demand recovery, which we expect will fuel Asian growth outperformance relative to developed markets. We are also keeping an eye on signs of stimulus out of China.

Emerging Europe has fared the best, outperforming both the S&P 500 and the MSCI Emerging Markets Index. In general, MENA has marginally lagged, and South Africa and Turkey have fared the worst, due to idiosyncratic drivers. In broad terms, the region is facing headwinds from restrictive monetary policy that will likely be a drag on investment. Although headline inflation is starting to recede, services inflation has remained sticky and may keep central banks from cutting rates sooner. However, we think MENA countries appear well positioned to withstand the current depressed oil price environment, which we expect to improve ahead, while structural reforms continue to support our positive view on the region as a whole.

We see various risks and opportunities across the asset class. From a near-term perspective, the combination of Brazil’s high real rates, low valuations, and position within its monetary policy cycle have created an attractive entry point. India and Mexico continue to present arguably the two best structural opportunities within emerging markets. China still moves with geopolitical headlines, but the Chinese Communist Party continues to side towards stimulus, and valuation multiples appear dislocated with growth and return prospects. We also see opportunities in smaller EM markets, including Greece and parts of Southeast Asia.

Commodities

Commodities tend to offer three strong benefits to portfolios: diversification, inflation protection, and return potential. Commodities are “real assets” that react to changing supply and demand fundamentals in different ways than stocks and bonds, which are “financial assets.” The supply and demand of commodities is affected by many factors such as capex (or lack thereof) within commodity industries, geopolitics, and regulation/policy. Today, policy efforts to address climate change by transitioning away from traditional hydrocarbons, combined with efforts to re-shore supply chains and build resiliency, are likely, at least on our secular horizon, to be quite supportive for commodities as an asset class. Climate change itself also appears to be having real adverse effects on agricultural commodities supplies.

Gold

The gold price took a hit in the first three weeks of August from the hawkish rhetoric of the Federal Reserve, before showing encouraging signals in the final segment of the month. The price steadily declined until August 21st, bottoming at $1,885 before going on to rally above $1,900. Despite taking a dip overall in its price, gold’s resilience remains evident. Paired with relatively low volatility – with prices fluctuating between $1,885 and $ 1,955 – this can be considered a positive signal. Additionally, the Chinese economy, especially its real estate sector, and geopolitical events will play crucial roles in shaping gold’s trajectory. So far, the risk of a global recession has been avoided, but a slowdown in China could have global impacts.

As usual, the geopolitical scenario remains a major topic for gold, which is still considered as the major haven in markets’ storms. Moreover, any positive news on the potential of a gold-backed currency proposed by the BRICS nations – Brazil, Russia, China, and South Africa – could boost the bullion price, although this still seems a way off.

WTIS

Saudi Arabia extended output cuts into November that will keep global supplies tight. By Bloomberg’s calculation the oil market could face the biggest deficit in over a decade. The amount of oil OPEC is pumping in the current quarter has been about 1.8 million barrels a day less than what is required to meet demand. Bloomberg projects that by the 4th quarter, that deficit is projected to widen even further. If OPEC production stays flat (and there are no further cuts imposed) inventories could shrink by 3.3 million barrels a day – which according to Bloomberg, is the largest shortfall since at least 2007.

The supply reductions imposed by OPEC are placing downside pressure on global stockpiles. Commercial crude stocks among OECD nations were 114 million barrels below their 2015-2019 average. According to Bloomberg, Saudi Arabia is aiming to bring oil price levels back up to $100 a barrel to finance costly domestic projects. The fact that the US Government has released a lot of oil from the strategic oil reserve and has yet to be replaced, is also bullish.

In previous cycles, the US shale industry has always responded to higher prices (in terms of ramping up exploration and production) but this could prove to be elusive in this cycle. OPEC therefore has at this moment in time, significantly greater pricing power. The key issues for financial markets are what kind of impact higher oil prices will have not just on inflation – but inflationary expectations now that US consumers are paying US$4 at the pump.

Agriculture Commodities

An unusually dry August has taken a toll on cereal and oilseed crops in Asia as El Nino intensified, and forecasts for lower rainfall in September are further threatening to disrupt supplies.

While wheat output forecasts are being revised lower due to dry weather in Australia, the world’s second largest exporter, record-low monsoon rains are expected to reduce the volume of crops, including rice, in India, the world’s biggest shipper of the grain, insufficient rains in Southeast Asia, meanwhile, could dent supplies of palm oil, the world’s most widely used vegetable oil, while extreme weather in top corn and soybean importer China is putting food output at risk.

| Sector | 12 Month Forecast | Economic and Political Predictions |

| AUD | 64c-72c

|

So long as the economy manages a soft landing, which is my base case, nominal and real rates in the US should come down. Against this backdrop, I expect the US dollar to continue to weaken against a broad basket of currencies. |

| Gold | BUY

$US1700-/oz- $US2100/oz |

We remain neutral overall. Gold looks relatively expensive and both real and nominal yields are a headwind. Platinum has a positive outlook due to supply risks and robust demand. |

| Commodities | BUY

|

We remain neutral on industrial metals, but we have a negative bias. The change in China’s approach to growth and broadly slowing global activities are headwinds. We are watching China closely for signs of stimulus. |

| Property | BUY

.

|

REITs should perform well when interest rates fall, given that real estate fundamentals appear reasonably healthy. Historically, REITs are one of the better-performing sectors during inflationary period. |

| Australian Equities | BUY

|

We expect that the Reserve Bank of Australia’s policy is very near to its terminal rate as inflation is cooling and consumer demand is showing signs of slowing. The Australian yield curve is still positively sloped, making it better relative value than many of its peers, and its IG spreads are some of the widest in the developed world and offer above-average pickup to other markets. |

| Bonds | Begin to increase Duration

|

Long-term valuations are attractive, in our assessment, fully reflecting monetary policy that is still expected to tighten a little further. Decelerating growth and tighter bank lending standards complement this view. |

| Cash Rates | Two further cash rates, bringing the rate to a peak of 4.60%. | Cash has appeal as a means of diversification and as a complement to the potential attractions of fixed income markets, and we maintain a moderately constructive view at this time. |

| Global Markets | ||

| America | Underweight

|

We remain of the view that equities face a challenging outlook. Tighter monetary policy and credit conditions will start to dampen growth. Valuations are not expensive however they are not cheap enough to provide a cushion if sentiment becomes negative. |

| Europe

UK |

Reduce

Hold |

The European market is more exposed to industrial and consumer discretionary sectors, which could see margins squeezed.

Valuations remain attractive and the large-cap index is internationally exposed so UK economic challenges matter less. |

| Japan | Accumulate

|

Japan equities have stumbled with the (very) partial normalisation of policy, but it does not change the fact that policy remains easy while reforms remain promising. |

| Emerging markets | Start Buying

|

We still like Latin America for its impending easing cycle and places like Mexico that benefit from near-shoring and US investment. Asia has paused for a breather, but South Korea and Taiwan still have favourable tech exposure while India benefits from cheap energy and potential new growth opportunities in manufacturing. |

| China | BUY

|

China signalled more economic support measures are imminent after authorities took a small step toward supporting the ailing property market by extending loan relief for developers. |