(Source: Merlea Macro Matters)

Summary

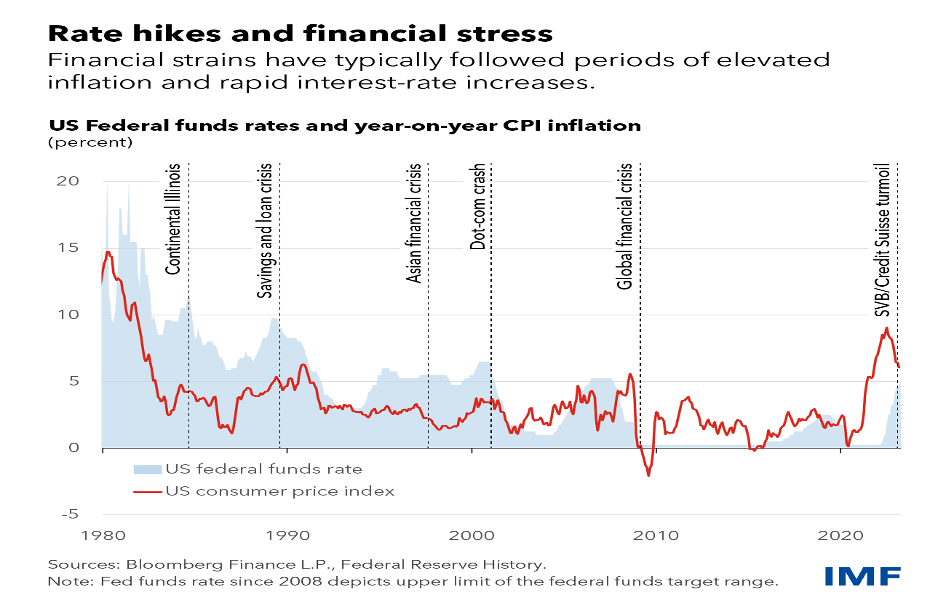

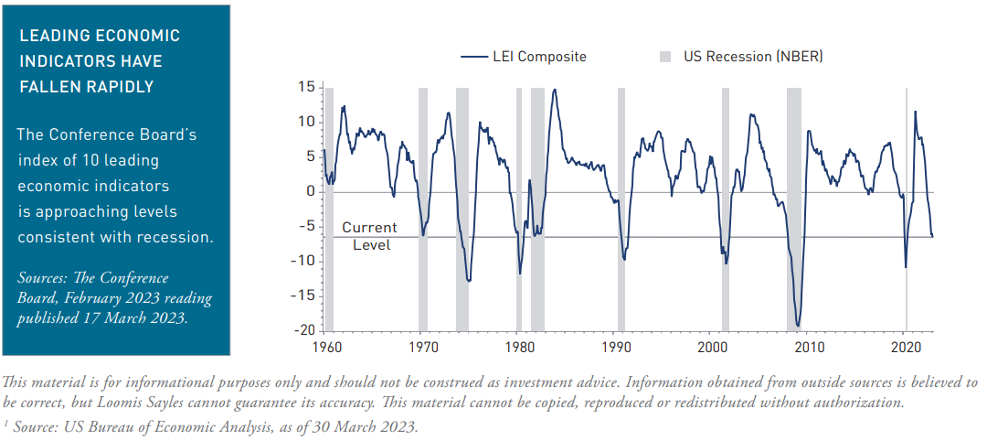

Could it be that a generational shift of investors since the 1980s fails to understand what high rates and central bank tightening really means? The cycle we are in is like no other witnessed since the 1970s and 1980s. Whilst the global economy and markets have been more robust than perhaps many imagined, given the central bank fight against inflation, we think time and patience are what is needed to see the economic dust settle. History has shown that changes in interest rates take at least 9-12 months to begin moving the economic dial. Just as the demise of Silicon Valley Bank and Credit Suisse seemingly came ‘out of the blue’, everything takes time.

While the bull case must be considered whereby the SPX could indeed break above the 4200 level and rally towards the record highs, a lot must go right in terms of the economy, I have doubts over the durability of the rally.

Global inflation data continues to suggest a gradual easing from the peak rates of late 2022. Month-on-month inflation rates among large, advanced economies continue to trend lower, and measures of supply chain disruptions have improved significantly, suggesting that consumer prices should continue to slow in coming months, although core inflation measures are proving sticky.

For now, concerns around the stability of the banking sector in the United States and Europe – following several bank failures in March – appear to have eased. The key factors that contributed to these failures appear to have been characteristic to these institutions, rather than representative of broader structural issues. The swift actions of regulators in both regions also seems to have cooled fears of financial contagion.

The increase of risks on multiple fronts and the tightening of financial conditions are taking a toll on household and business confidence and are likely to impinge negatively on medium-term growth. There are a few bright spots, with China and India likely to register strong growth.

Bonds

Two central banks on both sides of the Atlantic have been forced to provide hundreds of billions of dollars in emergency lending to shore up the financial system, and the Swiss financial group Credit Suisse has been absorbed into the larger UBS at the bidding of its regulator.

About half a trillion dollars has been wiped from banks’ stock market valuations. Two high-profile regional banks raised investor concerns and the U.S. government and Federal Reserve quickly moved to assure Americans that bank deposits were safe. Nevertheless, equities lost ground in the immediate aftermath as investors sought the relative safety of Treasury bonds. With demand for bonds quickly spiking, interest rates dropped rapidly in mid-March 2023, shifting the environment yet again for fixed-income investors. Considering the recent drop in bond yields, there’s more risk in the bond market today than existed prior to that decline.

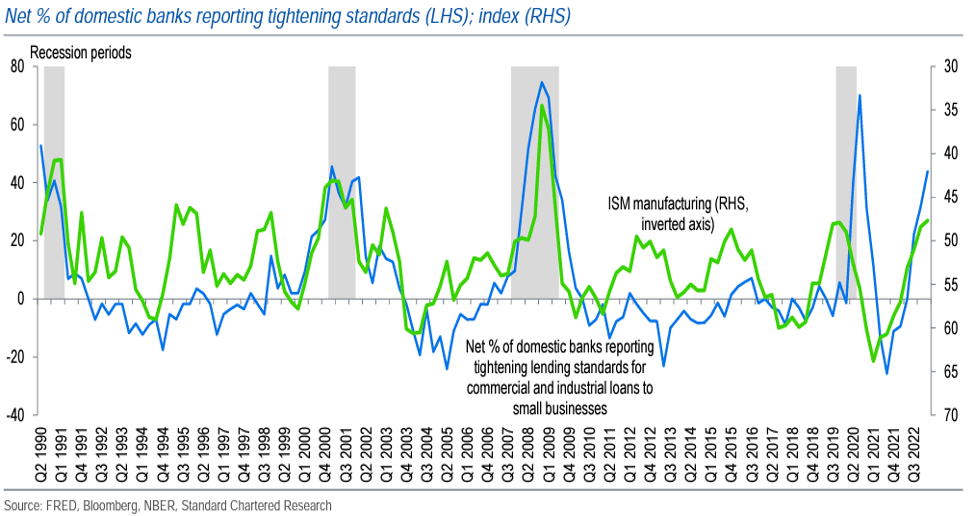

The macro impact of the coming credit crunch” in which she says “bank lending standards will likely tighten further in the U.S. and Europe.

A credit crunch is underway as banks tighten lending standards in response to recent stresses in the U.S., Eurozone, and Swiss banking sectors. Banks have become more conservative in lending practices and this impacts on the real economy will lead to slowing activity that could potentially evolve into a global recession.

While the outlook for other investments appears clouded, bonds look more attractive than they have in years, especially for income-seeking investors, given the broad repricing in 2022. Although the opportunities provided by higher rates could be short-lived. Getting inflation under control is the focus of Fed policy in the months ahead, but the central bank also wants to make sure it has room to cut rates if the economy goes into recession, potentially in 2023. Rate cuts are the most effective tool the Fed can use to stimulate economic growth and the central bank wants to be able to make impactful cuts when necessary. That could mean that the opportunity to add low-risk, high-yielding bonds to your income strategy may not be there if you wait too long.

Although yields could still rise further, we think the steepest part of the increase may be behind us. Bonds are poised to offer increasingly attractive real – or inflation-adjusted – yields if central banks can get inflation back closer to their target levels over the next couple of years. Furthermore, bonds may reassert their traditional role as a source of portfolio diversification if a slowing economy causes equities to slump, potentially smoothing the ride for investors.

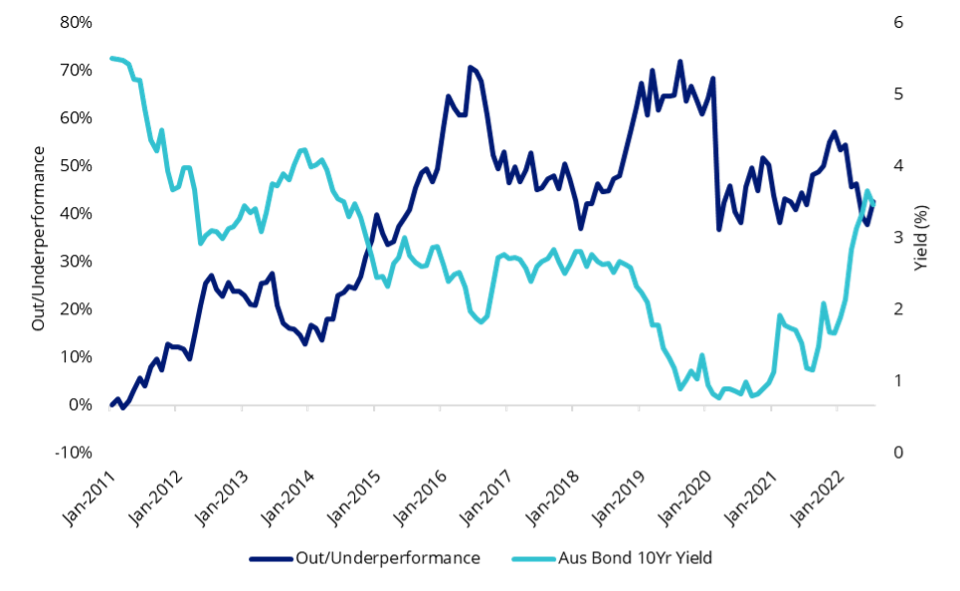

Listed Property

A-REITs have deleveraged since the GFC and offer exposure to subsectors with inelastic demand for their services in an environment where the global economic activity is subdued. We favour industrial and retail REITs in Australia and globally as both subsectors have shown improvements in occupancy rates. We also prefer exposure to Australian REITs as the economy is better positioned than most countries to manage economic challenges in 2023 and fundamentals are also more attractive at an asset class and subsector level. Australian listed property trusts are well positioned for an environment of elevated inflation and low growth.

Commercial leases in office, industrial and logistics typically have inflation-linked annual increases in rents written into multi-year contracts, providing inflation protection on income. The Australian economy is also better placed considering the anticipated influx of skilled migrants in 2023, creating further demand for office space. Around 300,000 people are expected to migrate to Australia in 2023 after several years of border closures significantly reduced migration figures.

Investors have priced in a negative, forward-looking view of listed real estate. Slowing growth and higher inflation have created a stagflation backdrop that has been especially challenging for REITs. Based on history, we believe that gap in performance will not persist. Indeed, private real estate returns are just beginning to slow as expected. Private real estate typically lags listed real estate due to its slower-moving price discovery and transactions.

We see current market conditions as a reason to overweight listed REITs compared to private. We think, however, that the market has priced in a worse recession than we expected. Against this backdrop, we believe the current downturn could present a similar outcome to previous recessionary periods where REITs have performed remarkably well after a downturn. In fact, we see the emergence of a backdrop that supports a REIT recovery over the next 12 months.

A-REITs performance relative to S&PASX 200 versus Australian government 10-year bond yield

From a macro perspective, REIT performance is negatively correlated with bond yield movements due to the change in borrowing costs impacting property valuations. The increase in government bond yields year to date due to rapid increases in the expected RBA cash terminal rate has been a major headwind for REIT performance.10-year bond yields in Australia have come down significantly from their peaks a year ago, which should see support for the sector, particularly the REITs that have been oversold.

Australian Equities

One economic indicator has been bothering me for months. The Australian benchmark share market index is now close to an all-time high — roughly 3 to 4 percentage points away from it. Earlier this year it fell close to 10 per cent, which would have been a “technical” correction”, but it rebounded and has stayed elevated. This indicator suggests economic “blue skies”, boom times and happy days. The National Australia Bank released the results of its Consumer Sentiment Survey covering the first quarter of this year. It found that, “by income, 4 in 10 (37 per cent) low-income earners are experiencing very high cost of living stress, but even among higher income groups, the share is 1 in 4 (23 per cent)”. Living costs are also weighing heavily on consumers who are renting, it said: “40 per cent of house renters report very high cost of living stress. And let’s not forget the jobs market is the tightest it’s been in around 50 years.

The Australia Stock Market Index (AU200) is expected to trade at 6966.80 points by the end of this quarter, according to Trading Economics global macro models and analysts’ expectations. Looking forward, we estimate it to trade at 6459.52 in 12 months’ time.

We’ve got the highest inflation rate in 30 years, the lowest unemployment rate in 50 years, and still two years before we get inflation back to the top of the target range. March quarter Consumer Price Index data showed inflation coming in basically as expected. Annual headline inflation eased to 7.0 per cent, from 7.8 per cent in the December quarter, with trimmed-mean inflation dropping from 6.9 per cent to 6.6 per cent. While easing inflationary pressures are welcome, the evidence continues to point to so-called “sticky” inflation — both overseas and here. Some price pressures are coming down. But gas, electricity and rents continue to rise and now, petrol prices may potentially be heading up thanks to new OPEC+ oil production cuts.

Treasurer Jim Chalmers reminded Australians that Australia’s inflation is expected to remain higher for longer, so I think it’s too early, way too early, to be talking about interest rate cuts and the balance of risk lies to further rate rises. Wherever you look, there are risks of not doing enough, and then we get high inflation. There are risks of doing too much and then we crash, have a recession and deflation and we also have the risk of stagflation where we have growth bumping along the bottom, and inflation just won’t go down.

I feel that central banks need to think in a different way and admit we need much more liquidity in some areas where we’re short of stuff, e.g., major manufacturing and value add in areas such as making steel and agriculture. We need much less liquidity in other areas where all we’ve got is bubbles and too much stuff e.g., coal, oil, gas, and housing (though subsidies).

So where do the investment opportunities reside? The economy is not the stock market and when an investor buys the stock market, they are buying earnings, not Gross Domestic Product. So where is the earnings quality? We believe this is to be found in companies that possess strong balance sheets as well as an economic moat (competitive advantage) enabling strong returns on invested capital. Such companies typically have pricing power and are leaders in their field. In addition, we also look for sectors that will do well irrespective of economic conditions. These include healthcare (due to ageing demographics), essential services (logistics, toll roads, plumbing supplies, telecommunications), and consumer staples. In addition, we believe that many of these sectors such as healthcare, infrastructure and housing are also likely to receive ongoing fiscal support given their critical role in society.

Global markets

Two camps have formed. The bulls see a soft landing with low inflation, while the bears see a recession and persistently high inflation. The truth will probably lie somewhere in the middle. In any case, stock markets are now pricing in a short and soft landing and may have gotten ahead of themselves somewhat. We now see more downside risks, fewer opportunities, and higher valuations and now recommend reducing global equity weights to underweight.

America

Looking past the banking crisis, two key market catalysts will remain front and centre in April: inflation and interest rates. The consumer price index gained 6% year-over year in February, down from peak inflation levels of 9.1% in June 2022, but still well above the Federal Reserve’s 2% long-term target.

At the last Fed meeting, the Federal Open Markets Committee (FOMC) hiked interest rates by one quarter of a percentage point—a second consecutive smaller raise after the mega hikes of 2022.The Fed released fresh long-term economic projections at the meeting, including an outlook that foresees just one more rate hike before the FOMC pivots on rates and hits pause.

The Fed is reaching a critical point in its battle against inflation, and the next couple of months will determine whether it can navigate a soft landing for the U.S. economy without tipping it into a recession.

In recent months, the U.S. housing market has softened significantly, and manufacturing activity has dropped. In addition, the U.S. Treasury yield curve has been inverted since mid-2022, something that’s historically been seen as a strong recession indicator. In fact, the New York Fed’s recession model predicts a 54.5% chance of a U.S. recession sometime in the next 12 months.

So far, the most convincing argument that a soft landing may still be possible, has been the resilience of the U.S. labour market. The Labour Department reported the U.S. economy added 311,000 jobs in February, widely exceeding economists’ expectations. The unemployment rate rose a bit to 3.6%, but that’s still down from 3.8% a year ago. Solid employment remains a favourable backdrop, in our opinion, suggesting a mild recession.

Value stocks have historically outperformed growth stocks when interest rates are high. High interest rates have a negative impact on discounted cash flow valuations, which can hurt high-growth stocks. Unfortunately, this does not change our view that the October lows for the S&P 500 need to be retested in the coming weeks/months. A cautious asset allocation stance with a tilt toward fixed income is warranted in our view given macroeconomic headwinds and a corporate profits recession appearing to take hold.

Europe

The likelihood of the eurozone entering recession has been building for some time. Recent market jitters have meaningfully increased the probability of such an outcome. Focusing on the data, fourth quarter gross domestic product (GDP) showed the

eurozone to have narrowly missed a technical recession. However, drilling into the numbers shows consumer demand weakening with domestic demand acting as a drag on growth. Further signs of a weakening in consumer demand can be seen in German retail sales data, which in January continued its downward trend. Combined with the fall in M1 money and tightening lending standards these data points show that monetary policy tightening is having its intended consequence.

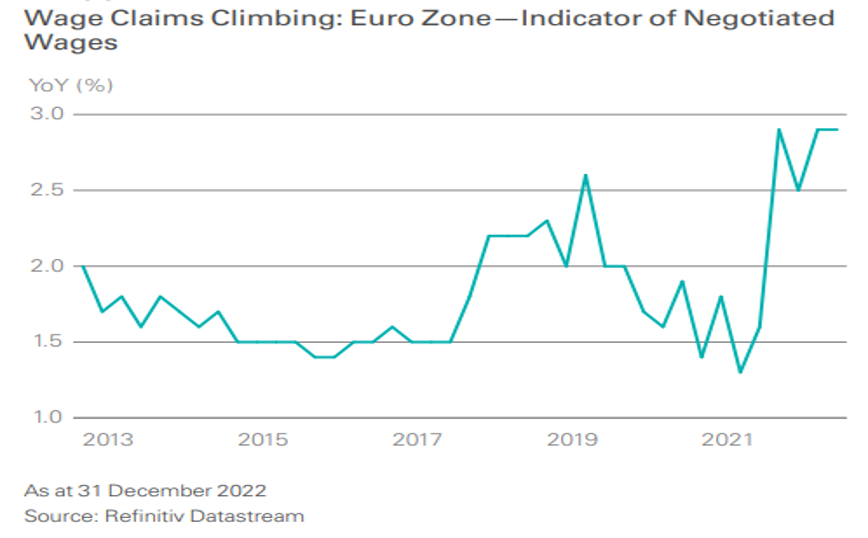

Despite the rising risk in the banking sector, sticky inflation and a surprisingly resilient labour market continue to call for restrictive monetary policy. While falling energy prices have caused headline inflation to drop, core inflation remains stubbornly high and is even increasing. This could become a problem in the months ahead as wage increases are exerting increasing pressure on broad euro zone inflation as workers demand higher compensation to counter real income losses.

Faced with still-elevated inflation and wage claim pressures, Europe’s central banks raised interest rates in March despite the turmoil in the banking sector, effectively sending a signal that there was no sign of a looming systemic banking crisis in Europe. The ECB hiked its key interest rates by 0.50% while the Bank of England increased their main interest rates by 0.25%. Our central expectation remains one that sees a bumpy economic landing ahead for the European economy, as the aggressive monetary tightening of the past year begins to bite fully.

United Kingdom

The UK economy, like the rest of Europe, is performing better than expected and a recession is no longer anticipated in the

near-term. The tailwinds have been the mild winter, lower energy costs, fiscal support to offset energy prices and economic resilience in Europe, which is the UK’s largest export market.

The medium-term headwinds are still in place The latest Labour market and inflation did little to suggest that the Bank of England (BOE) may be able to pause its rate-hiking cycle at its next meeting. While growth in private-sector pay and job vacancies eased in the December 2022–February 2023 period and the unemployment rate edged higher, growth in public sector regular pay continued its nearly year-long rise to 5.3% on a year-over-year basis. And while the pace of headline inflation slowed in March, it remained in double digits.

Japan

After several challenging decades following the collapse of the Tokyo real estate bubble, Japan is earning a second look from risk-conscious investors. Despite the talk of change that preceded the appointment of new Bank of Japan Governor Kazuo Ueda, little has changed for Japan’s economy.

In late March, overseas investors began buying Japanese corporate and government debt at the highest level since tracking began in 2005. Turmoil in the U.S. and European banking industries spooked investors, and yen bonds appeared a safe harbour. The consistency of Japanese central bank monetary policy, previously a source of mild annoyance for foreign investors, provided a favourable contrast to the less predictable actions of the Federal Reserve and European Central Bank.

In December 2022, the Bank of Japan tweaked its yield curve control policy, allowing 10-year Japanese government bond yields to double to about 0.5% from 0.25%. While there was discussion of a potential change of direction under central bank chief Ueda, the adjustment was relatively restrained when compared with other developed economies. If rates start to rise, this could help combat rising prices, stabilise the yen and help the economy. But the BoJ remain steadfast for the time being, stating it wants ‘good’ inflation and to provide continued support for the economy. The Bank of Japan expects headline inflation to fall below 2% around 2023-end, accounting for subdued global growth. However, even this relatively low level of inflation is likely to stress household finances in Japan unless real wages rise.

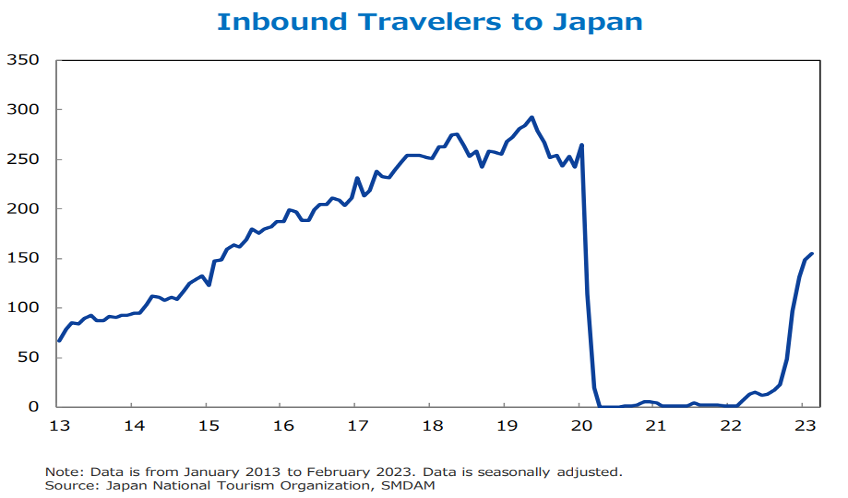

We expect that the return of Chinese inbound travellers could be a strong tailwind to the Japanese economy and domestic service stocks going forward.

The recovery in domestic demand will obviously benefit sectors such as those linked to tourism, air travel and the hospitality industry. While foreign tourists have recently returned to Japan, Japanese traveling within their own country tend to significantly outspend foreign visitors.

People removing their masks and opting to travel and eat out will likely be a gradual process. Therefore, it may take some time before changes in behaviour translate to domestic demand. When it does, labour shortages could become an issue as businesses which had reduced their workforce during the pandemic will likely scramble to hire again to keep up with increasing domestic demand.

On the growth front, Japan’s economy appears poised to grow 1.3% in 2023 – slightly shy of the U.S. but outpacing Europe – as exports to Asia rebound while domestic spending remains resilient.

China

China’s economic outlook has brightened following the transitory disruption related to the country’s exit from its zero-covid policy. Strong first-quarter GDP performance, driven by a rebound in private consumption, confirms growth forecast for 2023 (at 5.7% real expansion).

However, slowing global trade, strains in local public finances and an ailing property sector pose challenges to achieving higher growth. The new administration installed in March will reassure private and foreign enterprises via pro-business policies, although the restoration of confidence will take time after covid-related restrictions and crackdown campaigns unnerved entrepreneurs.

China will step up diplomatic engagement and revive its outbound investment to counter US influence. A Chinese invasion of Taiwan in 2023-27 is outside our forecast, given the likelihood of Western intervention and the devastating economic consequences of such a move, but the risk will rise towards the end of the 2020s.

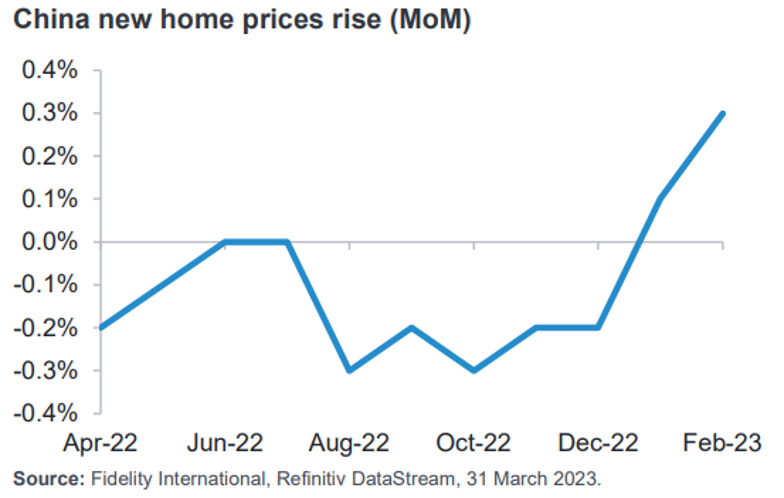

Homebuyers are returning in China with a rebound in sales activity in the major cities. China is counting on a pipeline of pent-up demand to power its housing market rebound. Two years of regulatory restrictions triggered a rout in the industry that cleared much of the speculative froth and uncovered real underlying demand. There is rising housing activity in top-tier cities as momentum picks up. New home prices in both tier one and tier two are showing signs of improvement.

While a rebound appears to be playing out in China’s heavily populated and provincial capitals, it is not yet clear that this will spread to lower-tiered cities where there remains a large amount of unsold inventory. Policymakers will need to provide more support to homebuyers to ensure that nationwide transaction volumes will grow year-on-year.

In addition, prospective homebuyers must feel sufficiently confident to tap the vast excess savings they have amassed during the pandemic. While it is too early to declare a nationwide rebound for the property sector, recent momentum establishes that post-Covid pent-up demand is real phenomenon and could bode well for construction.

Chinese equities outperformed the broader Asian market as sentiment strengthened amid the favourable policy shift for internet and gaming companies, as well as stabilising global financial conditions. Daily property sales volume in 30 major cities rose 44% yoy in March after averaging a 13% decline in January and February, indicating signs of recovery in China’s real estate sector. Korean and Taiwanese equities outperformed the broader Asian market, aided by strong inflows of foreign investment, which boosted attractively valued IT stocks.

In ASEAN equities, Singapore led after an upbeat forecast for Asian markets eased concerns over an economic slowdown. Indonesia was the next best performer. The Philippines, Malaysia and Thailand remained largely subdued in local currency terms as these countries posted capital outflows in March. Chinese equities outperform the broader Asian market.

Emerging markets

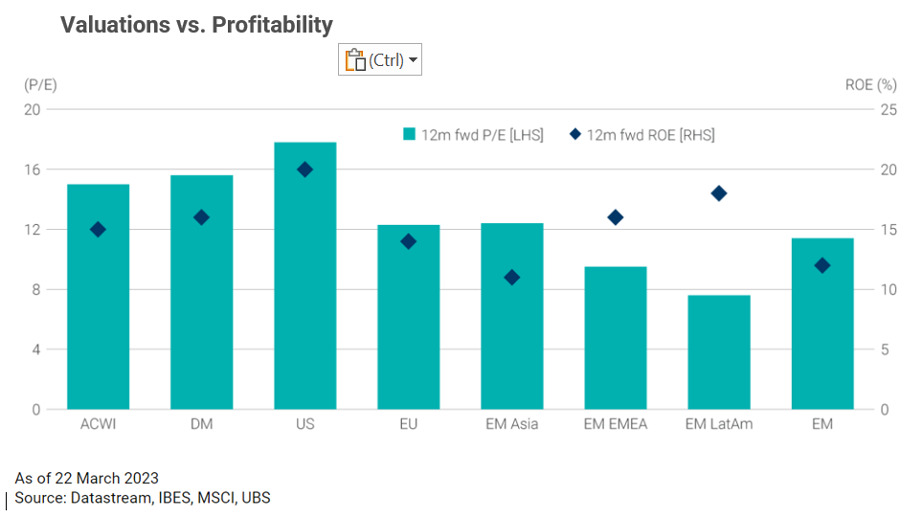

For investors, the steep drop in equity markets overall in 2022 and renewed market jitters in 2023 may raise the question of where to find attractive long-term opportunities. We believe that emerging markets may be one of the most mispriced asset classes, with valuations reaching some of their most attractive levels ever.

Over the past 20 years, emerging markets equities have evolved, serving as a source of interesting investment opportunities. Liquidity has deepened and investor interest has increased. Demographic trends and urbanisation are supportive of long-term tailwinds that may be able to accelerate growth for the asset class; with a growing middle class comes a consumer that is younger, increasingly more educated, and a faster adopter of new technology, with constantly changing consumption patterns and preferences.

Much capital has left emerging markets in recent years, and many parts of the asset class are under-owned and attractively valued, with high financial productivity (or return on equity, free cash flow yield, and dividend yield). Earnings growth is expected to be higher in emerging markets this and next year, driven by emerging Asia. Although emerging markets equities remain susceptible to a high level of macroeconomic uncertainty over the future path of the global economy and interest rates however, the complex still presents compelling opportunities. Most emerging market countries were early to raise rates and have positive real rates at a time when inflation seems to be peaking.

We may see the dollar losing momentum as the Federal Reserve’s rate-hiking cycle matures and as relative economic growth outside of the U.S. improves. As the dollar potentially weakens, EM countries could benefit from the relative appreciation of their own currency. Additionally, commodity exporters, such as countries in Latin America, could see commodity prices strengthening due to greater global demand.

Economic fundamentals are relatively bright with improved current account balances, and higher currency reserves and import cover. The relative attractiveness of EM valuations compared to developed markets, particularly the US, also creates opportunities for strong returns in the longer term. Overall, we believe the potential increase in emerging markets profitability, where the return on equity gap of emerging markets versus developed markets narrows, could also warrant a narrowing of the valuation discount to developed market. All in, we think it may be time for investors to reassess their exposure to emerging markets. Investors should consider rebalancing EM exposure with an eye toward China onshore companies, as well as opportunities in South Korea, Taiwan, and Brazil.

Commodities

Commodity markets continue to experience tension between micro and macroeconomic drivers, and between cyclical and structural dynamics. While the macro environment continues to present near-term headwinds for commodities markets, the structural backdrop and key cyclical factors present one of the most favourable medium to longer-term environments of the last two decades.

Low inventories are supporting futures curves in backwardation and attractive annualized roll yields, which have historically cushioned downside risk during recessions. Looking out to the medium term, structural underinvestment in energy and metals over the past decade continues to dampen new production growth and has exposed limited spare capacity. Commodities have gone from a state of abundance during the 2010s to a state of structural scarcity, with the potential to constrain global economic growth, elevate inflation, and drive concerns around food and energy security.

Gold

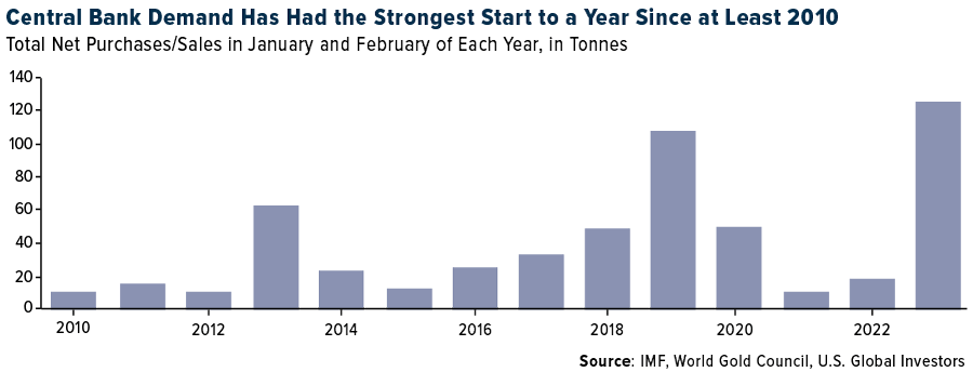

Central banks accumulated gold at the fastest pace on record in the first two months of 2023, according to a report by the World Gold Council’s (WGC) Krishan Gopaul. In January and February, central banks collectively bought a net 125 tonnes of the metal, the highest amount for the year-to-date period since banks became net buyers in 2010.

The countries reporting the largest purchases in the first two months were Singapore (51.4 tonnes), Turkey (45.5 tonnes), China (39.8 tonnes), Russia (31.1 tonnes) and India (2.8 tonnes). The Central Bank of Russia published an update on its gold reserves for the first time in about a year, so the 31.1 tonnes were likely accumulated over the course of several months instead of in January and February. In light of weak economic news, ongoing inflation, rising rates, a shaky banking sector and geopolitical tension, gold is catching a strong bid as it seeks to make a new all-time high. In April the metal touched $2,032 an ounce, just $43 off its record high, set in August 2020

WTIS

Surprise OPEC+ supply cuts announced on 2 April risk aggravating an expected oil supply deficit in 2H23 and boosting oil prices at a time of heightened economic uncertainty, even as industrial activity slows in the world’s largest economies and production growth outside the alliance appears robust. The bloc’s self-described “precautionary move” immediately triggered a $7/bbl jump in North Sea Dated crude to $85/bbl, up nearly $15/bbl from March lows.

The latest OPEC+ voluntary curbs of 1.16 mb/d come on top of an announced 500 kb/d cut in Russian output from March that has now been extended through the rest of the year, and a 2 mb/d reduction in targets taking effect last November. While apparently a move to support declining prices amid financial turmoil in mid-March, rising global oil stocks may have also contributed to the decision. In January, OECD industry stocks surged by 53 mb to 2830 mb, the highest since July 2021 and only 47 mb below the five-year average.

While oil demand in developed nations has underwhelmed in recent months, slowed by warmer weather and sluggish industrial activity, robust gains in China and other non-OECD countries are providing a strong offset. In 1Q23, OECD oil demand fell 390 kb/d y-o-y, but a solid Chinese rebound lifted global oil demand 810 kb/d above year-earlier levels to 100.4 mb/d. A much stronger increase of 2.7 mb/d is expected through year-end, propelled by a continued recovery in China and international travel. For 2023, world oil demand is forecast to rise by an average 2 mb/d, to 101.9 mb/d, with the non-OECD accounting for 87% of the growth and China alone making up more than half the global increase.

Meeting those gains may prove challenging as the new OPEC+ cuts could reduce output by 1.4 mb/d from March through year-end, more than offsetting a 1 mb/d increase in non-OPEC+ production. Growth from the US shale patch, traditionally the most price-responsive source of more output, is currently limited by supply chain bottlenecks and higher costs.

Our oil market balances were already set to tighten in the second half of 2023, with the potential for a substantial supply deficit to emerge. The latest cuts risk exacerbating those strains, pushing both crude and product prices higher. Consumers currently under siege from inflation will suffer even more from higher prices, especially in emerging and developing economies.

Agriculture Commodities

Cereal and oilseed crops across Asia are forecast to face hot, dry weather, with meteorologists expecting the El Nino weather pattern to develop in the second half of the year, threatening supplies, and heightening concerns over food inflation.

Meteorologist are seeing than a 50% chance of the El Nino phenomenon occurring, and this would affect vast areas of farmland in Australia, Southeast Asia and India are expected to face higher temperatures, while some growing regions in North and South America are likely to see more crop-friendly weather.

La Nina weather, characterised by unusually cold temperatures in the equatorial Pacific Ocean, has ended and El Nino, a warming of ocean surface temperatures in the eastern and central Pacific, is expected to form during the northern summer, according to U.S. and Japanese weather forecasters.

While La Nina brings cool and wet weather to parts of Asia, El Nino is typically associated with heat and dryness in the region. In North and South America, the weather tends to be favourable for crops during El Nino, although there are likely to still be pockets of adverse weather lingering.

Australia produced record wheat crops for the last three years, thanks to higher-than-normal rainfall brought by the La Nina weather. There is a forecast of warm and dry winter in the central and western parts of Australia.

In Southeast Asia, crucial for palm oil and rice exports, forecasters are expecting slightly below normal precipitation in June-August, although the region has ample soil moisture after heavy rains in recent months.

However, northern, and central parts of India, which are already reporting a lack of moisture, are set for below normal rains in the second half of the year, leaving the most-populous nation vulnerable to lower food output and higher prices. Typically, China sees dryness in its corn growing northern region and more precipitation in the soybean producing northeast during El Nino. For the United States, weather is expected to be favourable for the wheat crop.

| Sector | 12 Month Forecast | Economic and Political Predictions |

| AUD | 66c-76c

|

US dollar has weakened against major currencies, including the Australian dollar, amid concerns that rising interest rates could push the US economy into recession However, a rising trend in the $A is likely over the medium-term as commodity prices ultimately remain in a super cycle bull market. |

| Gold | BUY

$US1700-/oz- $US2100/oz

|

Gold prices have been on a general incline since the beginning of November as market turbulence, rising recession expectations and more gold purchases from central banks underpinned demand. |

| Commodities | BUY

As China reopens and economic activity increases progressively, we expect evident signs of robust demand for commodities by Q2 2023 |

We expect commodity prices to remain elevated in 2023 while forecasting most commodities to average lower on a y-o-y basis. Nevertheless, prices will still improve in 2023 from the levels seen in December 2022, driven by Mainland China’s improving economy and policies that will boost domestic demand for commodities. |

| Property | BUY

.

|

REIT balance sheets put them in a strong position in 2023 to compete against more highly levered market participants for property purchases. Several large-cap A-REITs look cheap GPT Group, Dexus Property Group and Mirvac Group |

| Australian Equities | BUY

|

While the coming year certainly won’t be without its challenges, we are tipping a modest gain for the benchmark S&P/ASX 200 index in 2023 of 4-7 per cent to near 7,350-7,550 points. |

| Bonds | Begin to increase duration.

.

|

Investors should actively explore bonds, particularly government bonds, to provide some stability to their portfolios at a time of tightening financial conditions in the markets and lending standards in the economy. |

| Cash Rates | 2.5%-3.5% | We think we are near the end of the RBA’s tightening cycle and expect one further rate hike in Q1 23 that will take the cash rate to 3.35 per cent. |

| Global Markets | ||

| America | Underweight

|

The US economy is slowing from a high level. However, the recent banking sector turmoil could further tighten financial conditions. |

| Europe

UK |

Neutral

Neutral |

Activity continues to recover. However, inflation is still high and sticky. Banking sector uncertainty could tighten credit conditions. The internationally focused large cap index is cheap on a range of valuation metrics. |

| Japan | Accumulate

|

Manufacturing activities are impacted by slowing global activity and cost pressures, albeit the service sectors are supported by tourism related reopening demand. |

| Emerging markets | Start Buying

|

Policymakers are taking concerted action to lift growth across all fronts, the note said. “This is the first time since 2019 where domestic macro policies and Covid management are aligned in supporting a growth recovery, rather than acting as countervailing forces. |

| China | BUY

|

Given the strength in first-quarter data, we have increased our outlook for full-year growth from 5.3% to 6.4%. With consumer confidence on the mend and credit growth accelerating, there is scope for a further pickup in activity over the coming quarters. |