(Source: Merlea Macro Matters)

Summary

Economic resilience remains a notable narrative across major developed economies, particularly in Europe and Japan, where performance has exceeded expectations. Europe benefits from decreased natural gas prices post-Russian-Ukraine tensions, alongside a global manufacturing resurgence and increased bank lending. The European Central Bank (ECB) hints at forthcoming rate cuts in response to declining core inflation.

Meanwhile, China’s economic landscape presents a mixed picture, with ongoing challenges in the property market and deflationary trends in consumer prices. The government’s ambitious 5% GDP growth target for 2024 suggests potential policy adjustments on the horizon.

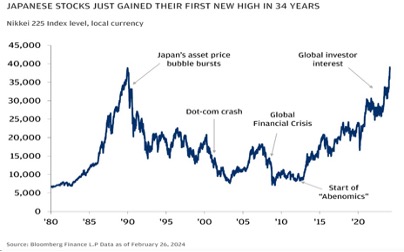

Japan continues to outperform, demonstrating robust economic activity, corporate profit growth, and strong financial market performance. However, concerns linger regarding fully priced equity valuations and potential tightening by the Bank of Japan.

In Australia, below-trend growth persists, but prospects of recession remain low. Wage growth moderates, inflation stays below forecasts, and the housing market displays resilience despite rate increases. The Reserve Bank of Australia (RBA) is expected to delay rate cuts, likely until the end of the third quarter.

Conversely, the UK faces subdued economic activity and a slower decline in inflation compared to its counterparts.

Equity markets seem unconcerned about potential rate cuts, despite rising bond yields indicating inflationary pressures. Investors express optimism about the robust economy while acknowledging risks of unexpected inflation impacting Fed easing prospects.

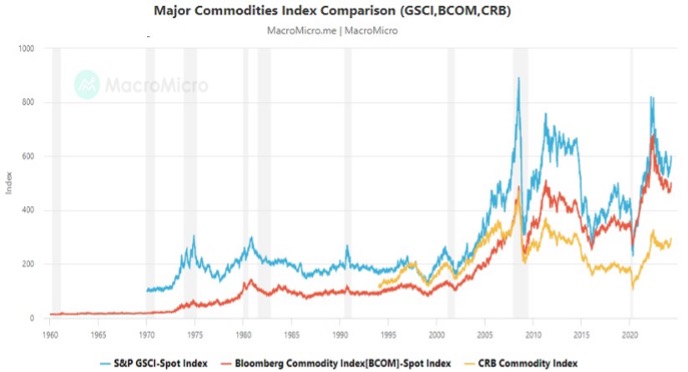

Commodity prices are on an upward trajectory, with significant increases observed in crude oil, gold, and silver. This trend may lead to higher consumer prices, potentially impacting inflation and influencing monetary policy decisions.

The VIX, a measure of market volatility, rose approximately 14% to 16.7, signalling increased uncertainty alongside a key reversal in equity benchmarks. Although still below its primary downtrend, the VIX seems to have bottomed out at 12. A potential breakout above this trendline could indicate an impending correction. I anticipate this correction may coincide with a delay in expected rate cuts, currently projected for June or July, pushing them towards the end of the year.

Bonds

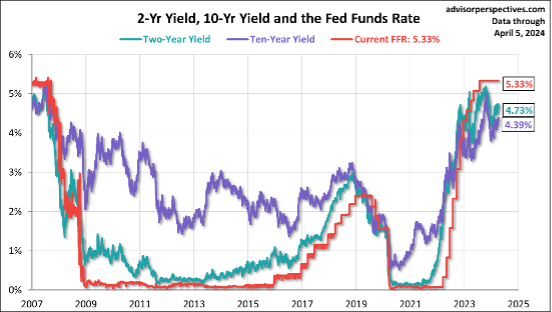

The issues around bond yields continues to evolve, presenting a complex picture. While surface-level observations suggest a calmer bond market compared to the extreme turmoil of 2022, underlying volatility remains significant by historical standards. This volatility stems from heightened macroeconomic uncertainty, driven by the tension between inflation and recession risks. Despite inflation persistently surpassing consensus forecasts in recent years, the market now anticipates a decline in inflation, interest rates, and bond yields from current levels.

The prevailing consensus assumes a benign scenario where inflation and interest rates have peaked, and economies will avoid recession. However, central banks have transitioned from being volatility suppressors to amplifiers due to conflicting policy objectives amid higher inflation.

This regime shift has led to structurally higher bond market volatility and variable bond-equity correlations, necessitating additional diversification strategies in portfolio construction beyond traditional government bond duration.

Regarding recent developments, the market initially anticipated significant rate cuts from the US Federal Reserve starting in March. However, downward revisions in forecasts, driven by services inflation, have led to expectations of fewer cuts, with uncertainty surrounding the timing of the first cut in June.

There is a risk that the Fed may delay interest relief, which could be problematic given the upcoming presidential election. Fed Chairman Jerome Powell appears inclined to maintain a dovish stance to avoid political implications. The catalyst for this shift has been a notable increase in US inflation, particularly in core measures, challenging the Fed’s easing direction. Similar trends in Australia further underscore the inflationary pressures. Decisions by the Fair Work Commission regarding minimum wage adjustments could further influence inflation dynamics, impacting a significant portion of the workforce.

Investors banking on substantial rate cuts face uncertainty pending the next US inflation print, which may pose downside risks to asset prices. Additionally, recent credit rating upgrades for major banks’ bonds indicate potential shifts in investment opportunities, with rising bond yields signalling reasserted inflationary pressures and casting doubt on anticipated rate cuts.

Given the narrowing gap in rate cut expectations, extending duration in government bonds could be prudent, with fixed income markets displaying reduced volatility. In the corporate bond market, understanding potential returns remains critical, with lower risk-free rates offering reasonable returns, although tight spreads may limit additional returns from compression.

Amid these turbulent market conditions, defensive asset allocations remain crucial. As global macroeconomic dynamics evolve and central bank priorities shift, prioritising diversified, high-quality bond strategies that emphasise liquidity and capital preservation can help mitigate volatility and risk.

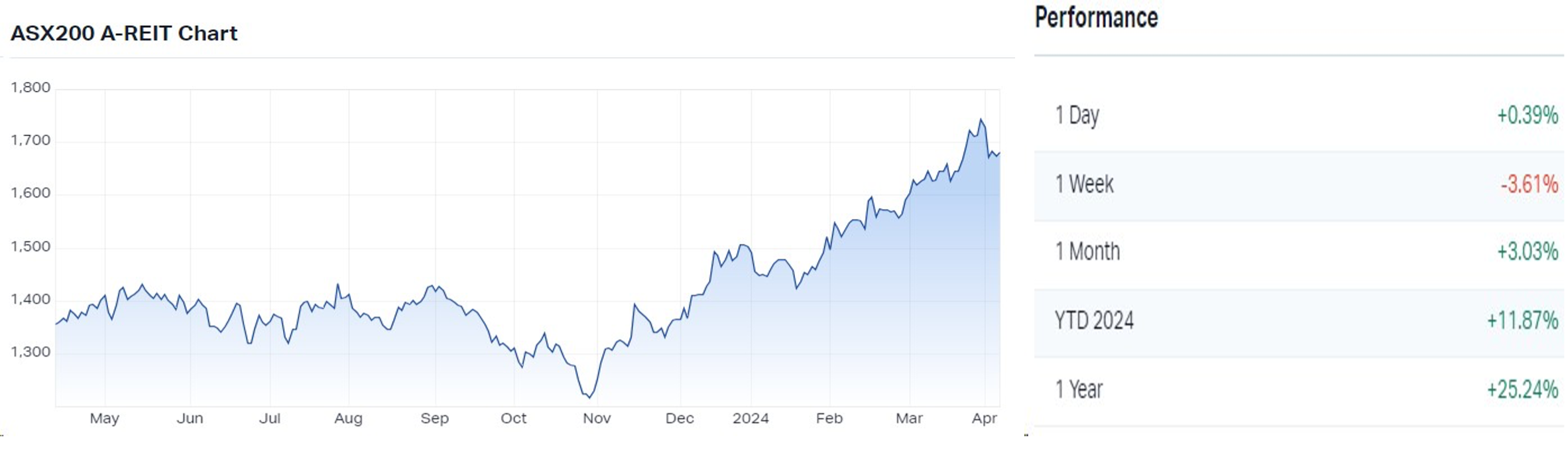

Listed Property

The outlook for REITs (Real Estate Investment Trusts) has turned decidedly bullish among analysts and fund managers ahead as the sector heads into its annual earnings season. As inflation eases, expectations for rate cuts are firming. That’s good news for the real sector whose fortunes are closely pegged to the cost of debt. As rates peak, the sector has a history of negative correlation to bond yields and interest rates, benefiting from both the plateau at the top of the interest rate cycle as well as the commencement of interest rate declines. Analysis shows REITs usually start to outperform the market from up to four months before the RBA begins cutting rates.

Yields on long-term bonds can be a key indicator for expected returns from REIT stocks. In the realm of valuing real estate companies, especially REITs on the ASX, Net Tangible Assets (NTA) often takes precedence as the preferred valuation method due to the minimal presence of intangible assets associated with these assets. Aussie REIT investors commonly refer to each REIT’s Price to NTA ratio, calculated by dividing the REIT’s price by its NTA. A ratio greater than one signifies the REIT is trading at a premium to its NTA, while a ratio less than one indicates it is trading at a discount. Historical data suggests that Aussie REITs exhibit high beta characteristics, delivering both substantial gains and losses depending on the trajectory of interest rates. Now, what lies ahead for Aussie REITs? Market yields appear to be on a downward trajectory again, theoretically bolstering ASX REIT performance.

The S&P/ASX 200 A-REIT (XPJ) index is a benchmark for Australian REITs and mortgage REITs. The index is rebalanced quarterly, and constituents invest in large-scale commercial property assets such as shopping malls, hotels, and office towers.

We believe the sector has likely weathered the worst, with the spread between industry asset capitalisation rates (“cap rates”) and the Australian Government 10-year bond yield moving from their narrowest the Global Financial Crisis to within “striking distance” of the long-term average. This suggests limited risks of further industry asset devaluations.

The cap rate, which measures a property asset’s net yield, along with its spread relative to benchmark bond yields, offer valuable insights into the property sector’s valuation. The recent trend of cap rates moving closer to long-term averages suggests a potential shift in ASX REIT asset pricing dynamics. Consequently, I foresee a more restrained decline in asset values compared to a year ago, indicating that certain ASX REITs are currently undervalued, even when considering potential asset devaluations.

Among ASX REITs, the office sector presents the most affordable options. With cap rates nearing their 20-year average, there is limited anticipation of cap rate expansion or asset devaluations. Our analysis identifies Dexus (ASX: DXS) and Centuria Office REIT (ASX: COF) as the top undervalued choices, based on their significant deviation from the Long-term Average Price to Net Tangible Assets (P/NTA).

In contrast, the industrial REIT space features Charter Hall Long Wale REIT (ASX: CLW) as an outstanding option. However, the retail REITs currently offer less value, as many trade near or above their Net Tangible Assets (NTA), considering potential further cap rate expansions. Specifically, Scentre Group (ASX: SCG) and Vicinity Centres (ASX: VCX) exhibit relatively robust Price to NTA ratios, while Stockland (ASX: SGP) appears expensive. Thus, investors may find opportunities in the office and industrial sectors, while exercising caution in the retail segment. A measure of a property asset’s net yield, and its spread relative to benchmark bond yields provide insights into the property sector’s value.

Australian Equities

Amidst a surge in equity markets during the initial months of 2024, with record highs achieved across the US, Europe, Japan, and Australia, questions arise: is this peak optimism? After the downturn of October 2023, the S&P 500 has demonstrated remarkable consistency, witnessing gains in 14 of the last 15 weeks, marking the most sustained rally since 1972. Meanwhile, the ASX 200 in Australia surpassed its previous peak of 7628.9 points from August 2021, buoyed by a favourable economic outlook.

Despite the optimism priced into global equity markets, we advocate for a more cautious approach towards expectations of interest rate cuts in 2024. The current levels of uncertainty are likely to persist until the ramifications of recent interest rate adjustments and the extent of economic slowdown become clearer. As the economy gradually transitions towards an easing cycle, the Reserve Bank of Australia (RBA) is anticipated to shift away from its tightening policy. However, the global economic landscape remains unpredictable, influenced by ongoing pandemic repercussions, recent rate adjustments, and broader trends.

The RBA monitors both domestic and international factors while evaluating the domestic economic progress. With GDP growth slowing down, weak consumer indicators, and subdued inflation, advocating for either a rate hike or cut presents challenges. Despite inflation remaining below previous peaks, attention is focused on the labour market beyond headline unemployment figures.

Australia experienced sluggish economic growth in the December quarter, with tightening pressures on household incomes restraining consumer spending. Treasurer Jim Chalmers acknowledged the shift in the economy’s risk balance from inflation to growth, recognising the effectiveness of high borrowing costs in curbing demand. Data from the Australian Bureau of Statistics revealed a modest 0.2% increase in real GDP in the fourth quarter, below the anticipated 0.3%, signalling a slowdown from the previous quarter’s 0.3% expansion.

Annual growth dipped to 1.5%, marking the lowest level since early 2021 during the pandemic-induced recession recovery.

Household spending displayed weakness, with essential spending rising by 0.7% while discretionary spending saw a decline of 0.9% in the fourth quarter. Both consumer sentiment and business confidence remained subdued, with retail sales weakening and annual price inflation stagnating at 3.4% over the past three months.

These trends send dual messages to the Reserve Bank of Australia – while the battle against inflation persists, the impact of high interest rates on consumers and businesses is evident. With population growth at unprecedented levels since the 1950s and housing approvals on the decline, an imbalance between demand and supply persists, posing challenges for the foreseeable future. In the housing sector, home values surged in major cities during the March quarter, except for Melbourne, according to CoreLogic. Sydney maintained its status as the most expensive city, while Perth, Adelaide, and Brisbane reached record levels following substantial increases over the past year.

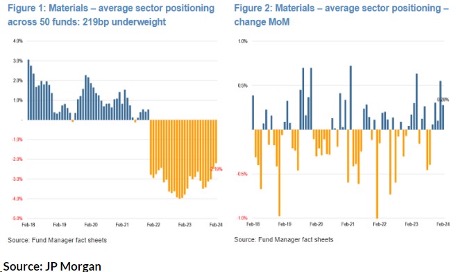

JP Morgan’s recent survey of approximately 50 Australian funds sheds light on market positioning, revealing a significant underweight position in the materials sector. This underweight stance is the lowest recorded since January ’22, suggesting a potential setup for a notable rotation into the materials sector in the months ahead. Similarly, in the US, where many fund managers are heavily invested in AI, mega-cap stocks, and expensive technology names, a similar rotation dynamic may occur.

Global markets

Investors have experienced a promising start to the year, characterised by a focus on stock market gains in the large-cap growth sector amid escalating equity market valuations. While the resilience of the global economy and the potential for future rate cuts may continue to support this trend, certain markets appear overvalued and vulnerable to profit-taking.

As is customary, markets confront a multitude of risks across economic, environmental, political, and geopolitical spectrums, which could introduce volatility in the coming period. The global economic and policy landscape is in flux, with the U.S. economy demonstrating resilience, while Europe struggles with subdued economic activity and Chinese consumers prioritise cost-effective leisure pursuits amid housing market adjustments. In Asia, export performance is on an upward trajectory, potentially opening the door for monetary policy easing by regional central banks.

The expected stable growth in the U.S., coupled with projected rate cuts by the Federal Reserve in mid-2024, could reinforce positive sentiment for both stocks and bonds. While some assets, like U.S. mega-cap tech firms and corporate credit, may seem relatively pricey, others remain reasonably valued and stand to benefit from advancements in generative artificial intelligence (AI) and the expanding consumer market in emerging economies (EM). Moreover, the healthcare sector, particularly biotechnology and pharmaceuticals, continues to exhibit promise driven by technological advancements.

America

The recent surge in Treasury yields presents a fresh hurdle for the ongoing stock market rally, which has propelled U.S. stocks to new record highs amid expectations of Federal Reserve rate cuts. While the S&P 500 saw a notable 10% increase in the first quarter, driven by optimism surrounding potential rate cuts, the upward trend in yields is now casting uncertainty on the magnitude of these anticipated cuts. With the 10-year yield reaching 4.4%, its highest level in over four months, concerns are emerging regarding inflated valuations and the impact of higher rates on both company and household borrowing costs. Historically, surges in the 10-year yield have unsettled the stock market, leading to previous selloffs.

Although the Fed has signalled its intention to implement rate cuts in 2024, robust economic data has prompted investors to question the feasibility of such actions. The U.S. economy continues to exhibit strong growth, buoyed by robust household spending supported by rising real wage growth and a low unemployment rate. However, corporate spending appears to be more mixed, with investments in AI and the tech sector expected to remain robust, while broader capital expenditure may be dampened by higher borrowing costs.

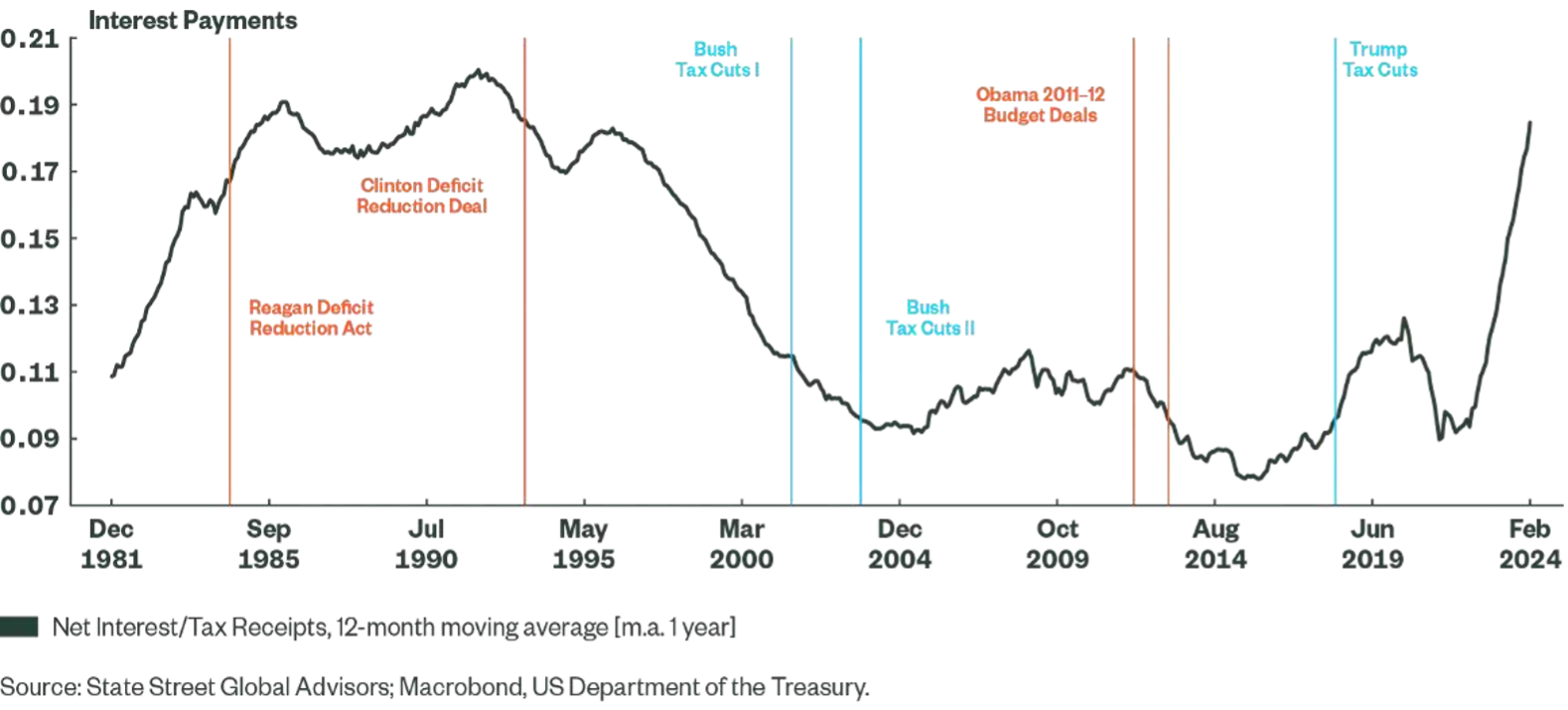

Considering the upcoming presidential and congressional elections, government spending is expected to remain a focal point. The US fiscal outlook has deteriorated over the past year, signalling an unsustainable trajectory. This trend is supported by higher rates, which in turn exacerbate the fiscal situation. The possibility of meaningful shifts in fiscal policy hinges on unified government control, with the Republican party potentially assuming control of all branches after the election. The next president will need to address the expiry of the 2017 tax reform by the end of 2025, with potential repercussions on consumption growth.

Republican control could likely avert broad-based tax increases. Although state-level public finances have stabilised, the general government primary balance remains negative, indicating a growing debt burden and higher debt servicing costs.

As a reserve currency, demand for US dollar-denominated assets remains robust. However, concerns arise regarding higher debt servicing costs due to the average maturity of US Treasury funding and increased issuance. This could indirectly impact private investment and limit public expenditure, posing challenges for the future.

Europe

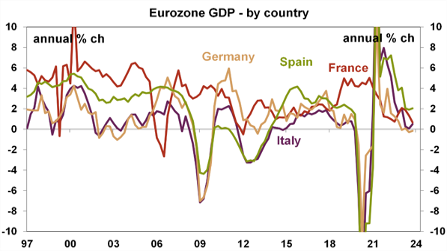

For the euro-zone, we anticipate a gradual increase in household real incomes amidst cautious consumer behaviour due to a weakening labour market. Business investment is expected to stall due to subdued domestic and international demand, while governments are likely to tighten fiscal policies further. As inflation is projected to meet its target in the latter half of the year, the

European Central Bank (ECB) plans to gradually reduce its deposit rate from 4% to 3% by year-end and around 2.25% by mid2025.

However, the impact of these rate cuts on growth is expected to be minimal due to their gradual implementation. The euro-zone economy is forecasted to grow slower than anticipated in the coming years, with declining inflation despite potential interest rate cuts by the ECB starting from June at the earliest. Household disposable income is expected to remain stagnant as employment growth slows and wage growth decelerates, thereby limiting consumption. Additionally, low consumer confidence and high interest rates suggest minimal reduction in household savings rates.

Near-term investment prospects appear grim, with construction investment likely to decline amid a housing market slowdown and reduced demand for credit among firms due to low industrial capacity utilization levels. Furthermore, firms’ external competitiveness has significantly deteriorated, with exports falling in four of the past five quarters. While global growth may improve, exports are anticipated to remain subdued this year before rebounding in 2025 and 2026.

In summary, the euro-zone economy is projected to grow slowly this year, underperforming consensus, and ECB forecasts, with persistent sluggishness

Despite potential support from looser monetary policy, the ECB is unlikely to commence interest rate cuts until June at the earliest, moving cautiously due to tight labour market conditions. Although headline inflation might increase, the core rate is expected to remain elevated for an extended period. The ECB’s deposit rate is forecasted to decline gradually, with the benefits of lower rates not fully realised until 2025, and any growth boost likely to be modest. Additionally, the Bank may accelerate Quantitative Tightening (QT) by ending reinvestments under the Pandemic Emergency Purchase Program (PEPP) and could commence asset sales next year.

United Kingdom

Headline inflation in the U.K. stood at 3.4% year on year in February, a significant decrease from 10.4% a year ago. This drop can be attributed to lower prices of energy, food, and non-energy industrial goods. However, cost inflation in the services sectors remains elevated, at 6.1% year on year in February, driven by robust wage increases. Job vacancies have decreased, but not enough to prompt a rise in unemployment, as labour supply remains slow to expand. The employment rate remains below prepandemic levels, with prolonged sickness contributing to inactivity. Workers are expected to retain bargaining power, leading to annual pay rises of 4.0%-5.0% in 2025 to cope with higher living costs.

Supply-chain disruptions in the Red Sea may contribute to increased inflation in the goods sector. Consequently, economic forecast that inflation will remain above the Bank of England’s target until 2026, with projections at 3.0% in 2024 and 2.3% in 2025, before returning to 2% the following year.

Despite these challenges, a resilient labour market, robust wage increases, and slower inflation are improving consumers’ purchasing power. Additionally, households have retained significant savings since the pandemic. Consequently, we expect consumption to drive economic growth from the first quarter of this year. Sentiment surveys, such as S&P Global’s PMI, indicate a rebound in activity in Q1, following a technical recession at the end of 2023, particularly due to recovery in the services sectors.

With some relief from energy costs, consumers are likely to increase spending on other goods and services, especially from April when the energy price cap is expected to decrease. Lower energy bills are also enhancing the terms of trade, with imports posing less of a drag on growth this year. Moreover, demand in key export markets such as the U.S. is anticipated to remain robust, with improvements expected in the Eurozone, particularly in the second half of this year.

Japan

As Japan’s economy enters the second quarter of 2024, upcoming wage negotiations may result in wage increases reaching the 4% threshold. This potential uptick implies a likely increase in real wages on a year-on-year basis during the July to September period of 2024. Consequently, the inflation rate is anticipated to stabilize around 2% as part of this wage-price cycle.

The economy is expected to find support from various factors, including the resurgence in motor vehicle production, growth in inbound consumption, recovery in service consumption, high levels of household savings, improvement in the silicon cycle, and comprehensive economic stimulus measures such as income tax cuts. However, risks persist in the overseas economy, alongside the possibility of domestic interest rate hikes and rapid yen appreciation.

We anticipate the Bank of Japan (BOJ) will gradually phase out its Quantitative and Qualitative Monetary Easing with Yield Curve Control (YCC) and lift its negative interest rate policy (raising the short-term interest rate to 0-0.1%) in April 2024. Following this adjustment, the BOJ is expected to incrementally increase interest rates while closely monitoring economic and price conditions. The short-term interest rate is predicted to climb to 0.25% in the October to December 2024 period, followed by additional rate hikes at a pace of 0.50% per annum. Despite these adjustments, an accommodative monetary environment is likely to persist, with real short-term interest rates remaining negative throughout the forecast period.

The Bank of Japan’s interest rate hikes, albeit gradual, are anticipated to contribute to the upward movement in long-term interest rates. However, the concern posts the removal of YCC lies in a potential sharp increase in long-term interest rates due to speculative activities. To mitigate this risk and stabilize long-term interest rates, the BOJ is expected to maintain its limit operations even after the elimination of YCC.

Japanese equities stand out as overvalued across various valuation models following the impressive run over the last six months.

We would expect upward pressure on bond yields this year as the central bank reduces bond purchases and gradually lifts the policy rate. The Japanese yen looks very cheap but is unlikely to appreciate much until the Fed cuts U.S. interest rates and/or the global economy slows.

China

Both technical and fundamental factors suggest that the Chinese economy may be on the verge of a turnaround, which could significantly impact both the local economy and stock market. The era of double-digit growth rates experienced by China between 2000 and 2010, often deemed miraculous, is now a distant memory both in terms of time and magnitude. Recent years have seen a moderation in Chinese economic growth, attributed in part to Beijing’s prolonged zero-tolerance COVID-19 policies and primarily to a substantial decline in the nation’s property market.

However, China’s $18.6 trillion economy has managed to sidestep some immediate downside risks, according to recent indicators, providing officials with additional time to convince investors that they can ignite a new growth engine for 2024 and beyond. While economic data for the January-February period and a factory owners survey for March have offered some relief to Chinese policymakers, who have been striving to demonstrate their ability to reignite the world’s second-largest economy, caution persists among analysts and investors.

Despite signs that the situation may not be worsening, there is a sense of urgency for officials to address the challenges and revitalize the economy comprehensively. Without a concerted effort to boost growth across all sectors, the market, once considered a global growth engine, could face stagnation later in the year.

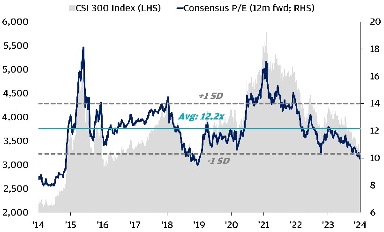

Despite uncertainties surrounding the U.S. election cycle and geopolitical tensions, China’s market presents potential opportunities. Valuations are discounted, with improving fundamentals indicating room for growth.

Key Points to Consider:

- Stimulus: Government support, though slower than anticipated, is steady. Signs of stabilization and growth are expected to emerge in 2024, with a focus on enhancing effective income and targeted fiscal policy adjustments.

- Geopolitics: Encouraging meetings between Chinese and U.S. officials suggest a less confrontational approach. Tariffs may pose challenges for U.S. inflation, leading to a more restrained stance.

- Manufacturing & Trade: Improved external demand could bolster China’s economy, though not currently in the base case scenario.

- Property Sector: Policy shifts prioritize housing for living, not speculation. Proactive measures aim to manage market supply, with households diversifying savings into capital markets.

- Reopening: Consumer confidence is rising post-lockdown, contributing to economic recovery.

- Valuations: The MSCI China Index trades at discounted levels, with P/E ratios and book values below historical averages, suggesting potential for growth.

China has implemented various measures to stimulate its economy, such as directing banks to increase lending to high-end manufacturing rather than real estate and reducing reserve requirements for banks. However, analysts warn that these policy interventions may be losing effectiveness and could potentially be scaled back. Despite these challenges, China has seen betterthan-expected factory output, retail sales, exports, and consumer inflation indicators in January-February, providing early optimism for Beijing’s ambitious target of achieving 5.0% GDP growth in 2024. Nevertheless, analysts emphasise that China stands at a crossroads and must adapt to a new era of high-quality growth to sustain its economic trajectory.

Emerging markets

The current view for the second quarter is that emerging markets are poised to maintain a stable growth rate of approximately 4%. Recent PMI surveys in manufacturing and services sectors indicate a trend towards economic expansion soon. Independent central banks in these markets, having initiated rate hikes early in response to inflation, are now reaping the benefits of their prudent monetary policies. Most emerging markets anticipate inflation to gradually approach their 2% target, with exceptions including Argentina, Turkey, Nigeria, Ghana, Pakistan, and Egypt where inflation remains elevated.

Concerns arise regarding political developments due to a record number of elections this year. However, election outcomes in

Bangladesh, Honduras, Indonesia, and Pakistan suggest continuity rather than significant political shifts. In countries like India and South Africa, fears of excessive fiscal spending ahead of elections have been alleviated by conservative fiscal policies. Geopolitical risks, such as conflicts in Gaza and Ukraine, have not had substantial economic or financial spillover effects, maintaining balance in financial markets.

Investor optimism towards emerging markets is on the rise, driven by favourable market prospects compared to advanced economies. Growing GDP differentials and potential US rate cuts, coupled with weaker US dollar prospects, make emerging market currencies more appealing to investors. Additionally, IMF programs in 36 emerging economies, including Kenya, Costa Rica, and Kazakhstan, often stimulate additional funding from capital markets, further supporting investor interest.

However, efforts are needed to reduce emerging markets’ dependence on growth and attract long-term capital inflows. Disparities among emerging markets highlight the importance of strong macroeconomic performance and institutional quality in accessing capital markets. Adequate capital is crucial for energy, food, and poverty reduction transitions to meet climate goals, with the current funding needing to double to approximately USD 2 trillion annually by 2030. Private investors seeking to balance financial and social returns should consider financing these transitions in emerging markets.

Commodities

For energy markets in particular, the renewed focus on geopolitical events and the associated impacts, while understandable given the increased frequency of conflict in recent years, should not distract from the reality that structural forces will likely remain the most significant driver of price direction over the mid and long-term.

Oil prices moved relatively little after the October 7 Hamas attack on Israel and the delayed November policy meeting of OPEC+ compared to how prices tend to respond to demand indicators and macroeconomic uncertainty. It would take a seismic geopolitical event, or an escalation of existing events noted above, to have a similar and lasting price impact.

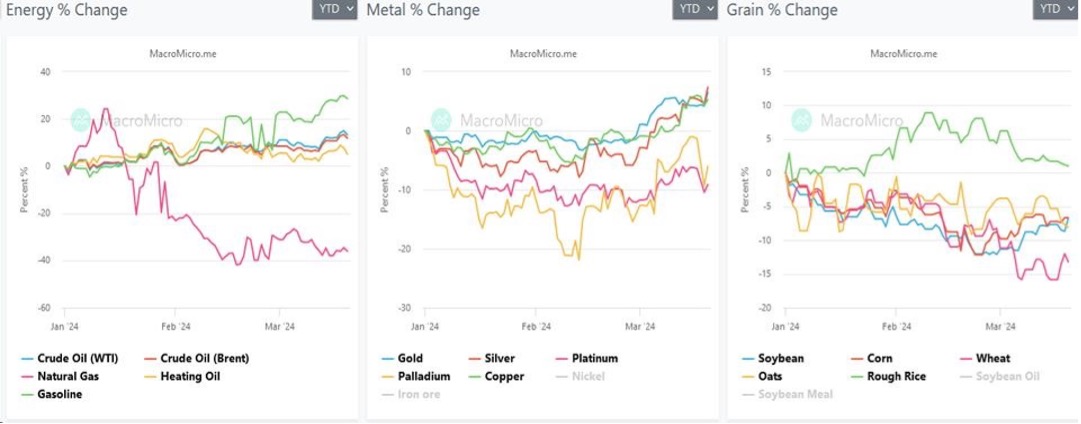

Government trade policies and climate events will likely be significant drivers of volatility in other commodity asset markets, particularly critical minerals, and soft commodities. Two policy trends could potentially disrupt trade flows and influence the market for these commodities. Copper’s recent breakout and the materials sector’s strong performance hint at a possible second phase of commodity price inflation. Last year, falling commodity prices played a significant role in reducing inflation, but this trend has reversed. Commodities, albeit not uniformly, are rebounding and breaking out. The recent rise in oil prices is especially noteworthy, and I anticipate a similar pattern for soft commodities and grains soon. This, in my opinion, will drive inflation upwards in the months ahead.

Gold

Spot gold prices have recently soared to a new milestone, surpassing $2,350 per ounce, and marking a remarkable 13% increase since the start of the year. This surge in the value of the precious metal commenced in mid-February and has been propelled by several factors including expectations of US interest rate reductions, geopolitical tensions, and economic challenges in China.

Throughout the past year, the primary catalyst influencing the trajectory of gold prices has been the Federal Reserve’s monetary policy stance. Growing anticipation surrounding the Fed’s anticipated shift has fuelled optimism, contributing to the ongoing rally in gold prices. While expectations for rate cuts persist, the Fed has emphasised the need for further evidence of inflation moderation before implementing significant changes. Should the Fed maintain its cautious approach to monetary easing, gold prices may face the risk of a retracement.

Foreseeing the months ahead, we anticipate continued volatility in gold prices as the market responds to various macroeconomic drivers, including geopolitical developments and Fed rate adjustments. Recent data from Comex indicates renewed investor interest in gold, with money managers initiating fresh long positions, indicative of bullish sentiment prevailing in the gold market.

Looking towards the future, we envisage a continued uptrend in long positions, driven by expectations of declining US interest rates amidst elevated gold prices. Additionally, gold has garnered support from robust central bank buying, as institutions seek to diversify their reserves amid geopolitical uncertainties. Last year witnessed substantial central bank purchases, nearing record levels witnessed in 2022.

Despite a slight deceleration in February, central banks persist in bolstering their gold holdings, adding a net 19 tonnes and extending the streak of consecutive monthly growth to nine, as reported by the World Gold Council. China has displayed robust demand for gold, evidenced by the People’s Bank of China’s continuous accumulation of gold reserves for the 17th consecutive month in March, driving official reserve assets to their highest levels since November 2015.

WTIS

Geopolitical tensions are expected to remain the main drivers of oil prices in 2024, with the war in Ukraine showing no sign of ending and the Israel-Hamas conflict already in its fifth month.

The Israel-Hamas war so far has not affected the region’s oil supplies. Attacks by Yemen’s Houthi rebels on shipping activities in the Red Sea, purportedly in support of Palestinians in Gaza, raised fears about oil supply via the route, but many shipping companies have redirected their cargoes around Africa and the Cape of Good Hope. However, the detour has resulted in greater shipping costs and trip time, which Offshore Technology estimates will add seven to twenty days.

OPEC+ (with key players Saudi & Russia) have recently reaffirmed extension of production cuts this year, a factor which is helping to support the recent price rally. However, these cuts are to some extent being offset by relatively strong US production, running at around 13 mbpd (albeit with some Storm Heather interruptions in Q1 2024). Higher oil prices result in increased operational costs for businesses, potentially leading to a pass-through effect on consumer prices and triggering inflation.

Agriculture commodities

Looking ahead, ongoing economic challenges, the possibility of a hotter summer, and below-average commodity prices are dampening the outlook for the first half of 2024. Three key themes impacting Australian agriculture: seasonal conditions, trade conditions, and economic headwinds. However, a more favourable economic environment is expected to bolster agricultural markets in the latter part of 2024.

Additionally, improvements in climate drivers such as El Niño and Indian Ocean Dipole (IOD) are anticipated to benefit the cropping sector and horticultural production, particularly in eastern Australia. Growing export demand for grains, horticultural produce, and beef production, along with opportunities in the red meat sector, are anticipated to improve prospects for Australian producers in the first half of 2024. The normalization of supply chains, which will continue to support Australian agricultural exports. Furthermore, the normalization of Australia’s trade relationship with China, along with potential expansions in trade with India and the United Kingdom, are positive developments. However, volatility in global grain markets due to the ongoing situation in Ukraine remains a concern.

| Sector | 12 Month Forecast | Economic and Political Predictions |

| AUD | 65c-72c

|

Commodities are a major driver of the Australian economy, with iron ore, coal, and other commodities responsible for 67% of all exports. Increases in demand for commodities can drive the value of the AUD up. |

| Gold | Hold

$US1800-/oz- $US2200/oz

|

Gold’s investment appeal is on the rise. Falling US real rates and a weaker dollar should benefit the precious metal, even though its valuation is no longer attractive after a near 10-per cent gain this year. |

| Commodities | Metals – BUY

Oil – BUY . |

Chinese metals demand growth (solar, grid, NEVs) has turned brighter since the start of the year. We may well have seen an inflection point in iron ore and other base metals, including nickel. We almost have certainly seen key inflections in precious metals, copper, and energy, which are all being driven higher by resurgent Chinese demand.

Global Oil Demand: Forecasted to Rise: Global oil demand is anticipated to increase by a higher-than-expected 1.7 million barrels per day (mb/d) in 2Q24. This growth is attributed to an improved outlook for the United States. |

| Property | BUY

.

|

Real estate values have been repriced throughout the year, due to the high interest rate environment and the macroeconomic outlook. Vacancies continue moderating but remain well below historical long-term averages across many property types. |

| Australian Equities | Reduce

|

The Australian equity market is trading around all-time highs, with the valuation multiple (price to 12-month forward earnings (P/E) multiple of a high-16 times) expanding to the highest level in two years and above historical-average level of mid-14 times. |

| Bonds | Begin to increase duration.

|

Peak in yields behind us but sticky inflation is a risk; a shallow cutting cycle means yields may decline slowly, expect a tight range to hold. |

| Cash Rates | RBA to hold rates at 4.35% for 2024. | Cash has appeal as a means of diversification and as a complement to the potential attractions of fixed income markets, and we maintain a moderately constructive view currently. |

| Global Markets | ||

| America | Underweight

|

A material pick up in inflation would likely cause the Fed to cut less than expected this year, putting downward pressure on both equities and bonds. |

| Europe

UK |

Start Buying

Accumulate |

Economic activity and PMIs remain weak, however market pricing is reflecting this fairly. A rebound in global manufacturing and a stabilization of the Chinese economy should lend some support to Eurozone equities in the short term, despite lingering structural headwinds.

Valuations remain attractive on multiple metrics, however the earnings outlook is looking less positive. |

| Japan | Accumulate

|

In Japan, business activities continue to recover especially in the service segment, which has been supported by reopening and tourist flows, while manufacturing is benefiting from tech related activities. Room to run further, given solid nominal

GDP growth, corporate governance reform driving up ROE. |

| Emerging markets | Start Buying | China’s near-term outlook remains uncertain, but we are more positive about the outlook for Mexico, Brazil, and India. |

| China | BUY

|

China’s economy is expected to moderate, but still grow at a solid pace in 2024. The ongoing transition to a more consumption-led economy remains fragile. |