As you know, we had a significant announcement 2 weeks ago, of the JobKeeper payments that would be made to eligible businesses, and sole traders, to ensure that each of their eligible employees receives at least $1,500 per fortnight (before tax).

Since that time we have had the legislation passed, and a detailed statement on the details, which has helped iron out many of the queries around who would be eligible and when. What we are now faced with, is how we implement that; as many of you are now processing payroll entries for employees that will be eligible.

Rather than bombard you with constant updates; we will try here to collate all information that we have, and that we know about those key features at this point in time:

When is a business eligible;

- A business with a turnover under $1billion is eligible if they estimate their GST turnover (or equivalent turnover if not registered for GST) has fallen, or will likely fall by 30% or more

- Key points above;

- You can estimate that your turnover will likely fall. That is particularly relevant because many businesses have commented that March figures were fine although it was becoming quiet; but April will almost certainly meet the criteria. This is fine; if you can reasonably estimate the decline; you can register and participate in the program now. If your figures are too hard to predict or it might be close; please stay in touch with us to monitor and review. You can opt into the program at a later date.

- A sole trader / trust / partnerhip / company can all be eligible for JobKeeper

- These business structures must all meet the same decline in turnover tests as outlined above

- A sole trader can nominate themselves as the recipient of the JobKeeper payment

- A partnership, trust or company that usually remunerates the businss owner by way of a partership drawing, distribution, or dividend (anything other than a wage through payroll), can only nominate 1 individual person as a recipient under JobKeeper.

- Where you have a (as we call them) ‘Mum & Dad’ business; you are most likely going to have to nominate 1 partner to receive income support through JobKeeper [via the ATO and linked to business decline], and the other through JobSeeker [via Centrelink, and linked to personal income decline]

Which employees are eligible;

- It is important to note that this is a ‘one in, all in’ program. If you are eligible as a business, and you register to participate, you must apply JobKeeper for ALL eligible employees of your business. You can not pick and chose the employees this will apply to.

- Eligible employees of your business include;

- Current employees (including those stood down)

- All full-time, part-time, and ‘long term casuals’. Long term casuals have been given definition by the Fair Work Act and include those employed on a regular and systematic basis for longer than 12 months as at 1 March 2020.

- Over 16yrs of age on 1 March 2020, an Australian citizen, and an Australian resident for tax purposes.

- Not in receipt of a JobKeeper payment from another employer.

- You must notify your staff of your intention to participate in JobKeeper (link to form below), it is recommended that you receive receipt & acknowledgement from those employees and keep it on file.

- ATO Form for Employee Nomination Notice; https://www.ato.gov.au/assets/0/104/300/387/d1aab7f2-fbe8-44b8-9ec1-4885ded1088e.pdf

- There are many queries here with regards to what you can reasonably expect of your employees if they are in receipt of JobKeeper. If you Google this, there are already hundreds of well meaning articles, although I am finding that too much information is almost harder to process.

The best two articles that I believe comprehensively cover the most queries are:

- The Treasury Guidelines and Frequently Asked Questions – Click Here

- The Business SA JobKeeper Payment Employer Guide – Click Here

When does it apply;

- The JobKeeper program commenced on 30th March 2020, and will run until 27 September 2020.

- This means that if you estimate your turnover from the 30th March onwards, will drop by at least 30%, and you have registered and are participating in JobKeeper; all payroll entries you make for payroll periods after that date may be subject to JobKeeper.

- If you do not believe your turnover will decrease until a later date; you can continue ‘as usual’ until you reach the point that you believe revenue will start to decline and then apply JobKeeper to salaries paid.

- This most likely will create 1 of 3 situations;

- You have employees that have been stood down, or are not working and currently earning nothing. You will need to pay them the minimum $1,500 before tax. There is no super guarantee on this payment (because it is 100% JobKeeper).

- You have employees that are working, but currently earning less than $1,500 per fortnight. You will need to pay them ordinary wages for the income earned, and top them up to the full $1,500 per fortnight. There is super guarantee on the ordinary earnings, but not on the JobKeeper top up.

- You have employees that are working, and currently earning more than $1,500 per fortnight. Your payroll entries will not change (process and pay as usual). Super guarantee is processed as usual on the entire wage.

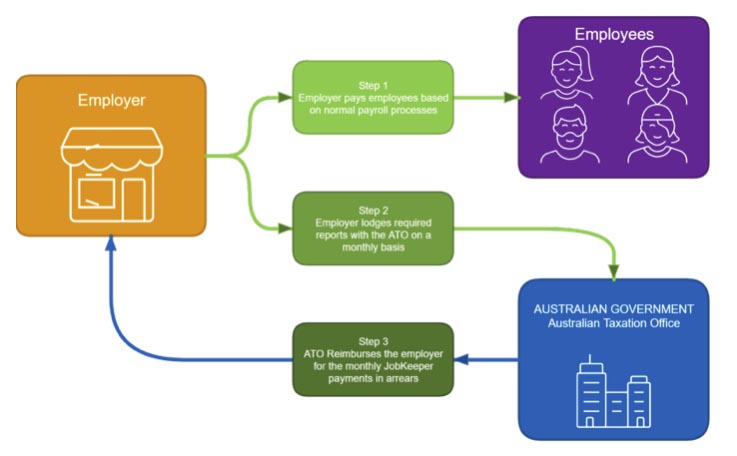

- In all cases above, the employer will receive the $1,500 per fortnight payment, per employee. This is paid back to the business at the beginning of the following month.

- In all cases above, the ordinary earnings, and the JobKeeper payment are taxable in the hands of the employee; and as such the payments are both subject to PAYGW.

- This most likely will create 1 of 3 situations;

How to process this in Payroll;

Both Xero and MYOB have put guidelines out as to how this can be processed through their payroll systems.

For further information you should speak to your accountant or tax adviser on how this will work best in your specific circumstances.

Payroll process guidelines here

Payroll process guidelines here

Key Steps; How to report, and claim your payments back;

- Ensure you have registered for JobKeeper. This can be done via www.ato.gov.au; or contact our office, and has been available since 30th March 2020.

- Put your application in through the ATO business portal, or through us via the ATO tax agent portal. This is to confirm your business eligibility eg 30% estimated reduction in turnover, contact our office for any assistance. This will be available from 20th April 2020.

- Confirm the eligible employees that will be participating (complete notification forms, and put signed confirmations on file)

- Make correct payroll payments to those employees (minimum $1,500/ftnt), from the beginning of the period that you anticipate your business downturn will commence.

- The employee payment details will be prefilled from their STP (Single Touch Payroll) reports. If you are not using STP enabled software, you will need to manually provide this information to the ATO each month. There will be monthly reporting to the ATO required for the prior month activity. We are awaiting further information about this format and process. This will be available from 4th May 2020.

- Payments will be made into the nominated business bank account after reports have been lodged to the ATO; in the first week of the month following JobKeeper payments to employees.

As you can see, there is quite a bit of information to absorb, and this will be slightly different for each client. Wherever possible, we are going to endeavour to make as much available to you as possible in an efficient manner.

While we are here to assist and support you, your accountant is the one who will need to do the figures for you and to ensure that you can meet the criteria.

Keep safe & well.

From the team at DMA Financial Strategists