We are in unprecedented times. We are in the midst of what can only be described as a rapidly evolving situation, with the possible impact on society changing it seems on a week to week (and maybe even now daily) basis.

The good news is that over the last week governments have realised the severity of this situation and we have seen real action by way of decisions in the areas of health, travel and border security with a view to flatten the transmission curve.

From a government and central bank viewpoint, stimulus has been injected into our domestic and global economies with a view to creating confidence, liquidity and avoiding or reducing the impact of a recession. Rates fell again last week, and we also would not be surprised to see rates at zero across the developed world again by the end of the financial year.

That is all at a macro level, but what is really important is that you do what you can to focus on your personal economy (and your health) at this time.

So in terms of what we are doing as advisers, as you would expect, we have been busy trying to gather and analyse the information as it comes to hand.

Advice

We have been checking in with clients to ensure they have the cash set aside to get through what will be a challenging period. For our retirees, this means having at least two years of spending in cash and term deposits, and for accumulators that means at least three months of spending in cash and strong consideration to maybe increasing regular wealth plan contributions whilst the sales are on.

Investment strategy

We continue to research and review each of the assets within the models that our clients are invested in, including some tactical shifts as a result of the volatility. At this time the Investment Team will opt for changes that we know will provide us with a certainty outcome.

We have reviewed our corporate credit exposure, and remain comfortable that the businesses are sound. With the recent flight to safety and fall in the value of the AUD, we are also giving consideration tohaving some portion of your international portfolio hedged.

In terms of our investment portfolios, through careful manager selection, we have sought to reduce risk and periodically we have rebalanced the asset allocation and investments (where available). This has meant that out portfolios have not fallen as sharply as the overall investment markets, which will mean your recovery is quicker. When the recovery does come (which it will).

Government Stimulus

In a rapidly evolving response to the spread of COVID-19, the Federal Government’s second support package announced over the weekend has flicked the switch to more income support for retirees and workers.

Between the first $17.6 billion package announced on March 12, and this latest $66.1 billion package, the emphasis has shifted from stimulus aimed at keeping businesses up and running, to support for individuals to get them through the crisis.

Importantly, casuals and sole traders along with employees who lose work due to the coronavirus shutdown will receive help.

Retirees affected by falling superannuation balances and deeming rates out of line with historically low interest rates have also been offered some reprieve.

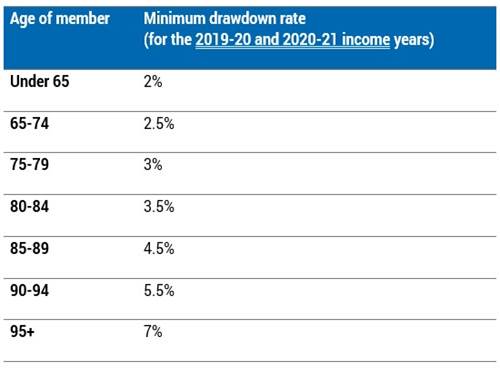

Minimum pension drawdowns halved

Self-funded retirees will be relieved the Government has moved quickly to temporarily reduce the minimum drawdown rates for superannuation pensions.

Similar to the response in the wake of the Global Financial Crisis, minimum drawdown rates for account-based pensions and similar products will be halved for the 2020 and 2021 financial years.

This means retirees will be under less pressure to sell shares or other pension assets in a falling market to meet the minimum payments they are required to withdraw each financial year. For example, a 75-year-old retiree will now be required to withdraw a minimum of 3 per cent of their super pension balance this financial year and in 2020-21, instead of the usual 6 per cent.

Please note this will not automatically decrease your pension and it is optional – your pension will not reduce unless you choose to.

The new rates are in the table below:

Deeming rates cut again

In addition to the cut in pension deeming rates announced in the first stimulus package, the Government has cut deeming rates by a further 0.25 percentage points. This reflects the Reserve Banks latest cut in official interest rates to a new low of 0.25 per cent.

Deeming rates are the amount the Government ‘deems’ pensioners earn on their investments to determine eligibility for the Age Pension and other entitlements, even if that rate is lower than they actually earn.

This move will bring deeming rates closer in line with the interest rates pensioners are receiving on their bank deposits, especially those with lower balances.

From 1 May 2020, deeming rates will fall to 0.25 per cent on investments up to $51,800 for singles and $86,200 for couples. A rate of 2.25 per cent will apply to amounts above these thresholds (see table).

Early access to super

More controversially, the Government has also announced it will allow anyone made redundant because of the coronavirus, or had their hours cut by more than 20 per cent, to withdraw up to $10,000 from their super this financial year and a further $10,000 in 2020-21.

Sole traders who lose 20 per cent or more of their revenue due to the coronavirus will also be eligible.

The Treasurer said the process is designed to be frictionless, with eligible individuals able to apply online through MyGov rather than going to their super fund.

While this provides an additional safety net for individuals and families who face the loss of a job or a significant fall in income, we do urge our clients to consider accessing their super as a last resort.

Taking a chunk out of your retirement savings now, after a big market fall, would not only crystallise your recent losses but it also means you would have less money working for you when markets recover. So before you do anything, speak to us and look at other income support measures.

Relief for those out of work

All workers, including casuals and sole traders, who lose their job or are stood down due to the coronavirus shutdown, will be eligible for a temporary expansion of Newstart (now called JobSeeker) payments to new and existing recipients.

Individuals who meet the income test will receive a coronavirus supplement of $550 a fortnight on top of their existing payment for the next six months. This means anyone eligible for JobSeeker payments will receive approximately $1100 a fortnight, effectively doubling the allowance.

This measure includes people on Youth Allowance, Parenting Payment, Farm Household Allowance and Special Benefit.

Importantly, the extra $550 will go to all recipients, including those who get much less than current maximum fortnightly payment because they have assets or have found a few hours of part-time work.

Support for pensioners

Pensioners have also received additional support. On top of the $750 payment announced on March 12, an additional $750 will be paid to any eligible recipients, as at 10 July 2020, receiving the Age Pension, Veterans Pension or eligible concession card holders. This payment will be made automatically from 13 July 2020.

Please note we are in the process of updating centrelink schedules for all our Age Pension clients to ensure that you are receiving your maximum benefits. Please understand the effect of this may not be quick as the Centrelink system is currently over loaded with demand.

More support to come.

This latest support package is unlikely to be the last as the Government responds to a rapidly evolving health crisis and progressive shutdown of all but essential economic activity.

If you have any questions about your investment strategy or entitlements to government payments, please don’t hesitate to call.

Information in this article has been sourced from https://treasury.gov.au/coronavirus/households

Office availability

From now DMA Financial Strategists will do our part for social distancing. We will be available for phone calls or video meetings to try and best go on with business as usual but we will be limiting meetings held in the office in the short term. I understand how difficult this will be but we will use technology to the best of our abilities to talk with you.

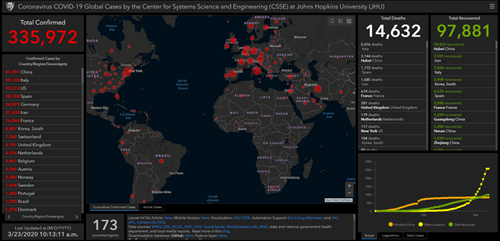

Coronavirus chart

If you enjoy data and facts and want to track COVID-19 more closely you can do so with this interactive chart from John Hopkins University.

https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

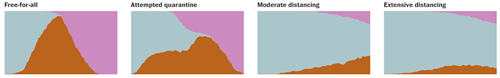

Social distancing

This is a great article on social distancing by the Washington Post

https://www.washingtonpost.com/graphics/2020/world/corona-simulator/

I hope that you and your families stay healthy and safe.

From David, Rodica, and the team