WEEK IN VIEW

It’s difficult to know where to begin. It’s all becoming such a blur at the moment with information changing by the minute, it’s making it hard to keep up.

Yesterday the RBA made the only decision they really could and cut interest rates to 0.25%.

It is the first time a rate cut has been announced outside a regular meeting since 1997, and is a glaring sign of just how severe the situation is becoming.

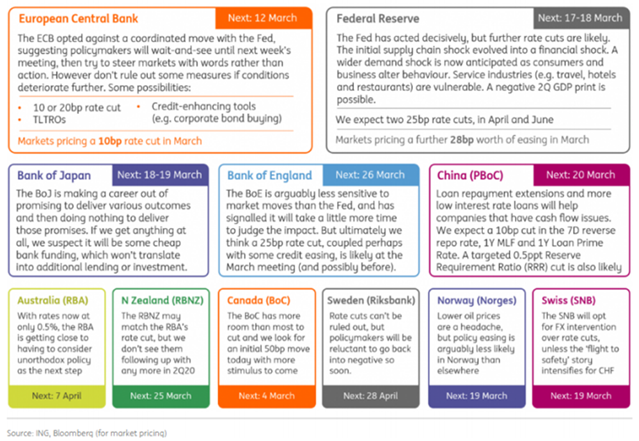

Below you will see a chart of what other countries around the world are doing in relation to their Monetary policy.

Governor Philip Lowe also announced other measures – including quantitative easing – which are designed to make sure credit remains available to individuals and businesses. These all seem like necessary measures as Australia heads for its first recession in 30 years on the back of the world being in lockdown essentially.

New forecasts see Australia’s unemployment figures looking to hit 7% by October all from this disastrous start to 2020.

It’s hardly surprising as we know many business are struggling, with the flow of traffic everywhere in the nation having slowed to a standstill.

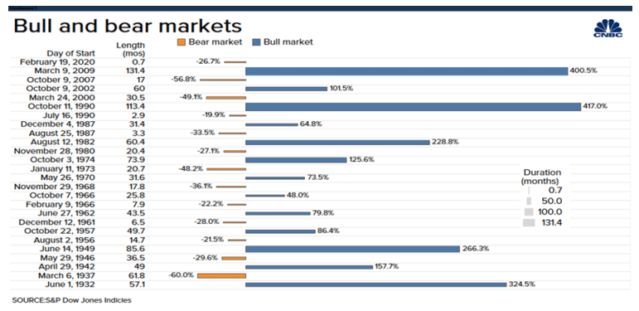

As we move into this Bear market, the chart below will show us on average how long we spend in that state before we see a run back to the Bull market. On average the S&P 500 Index has fallen by 33% during a Bear market but as you can see below the bull run has bounced back more than enough to make up for these downturns.

It’s going to take a fiscal policy spend to keep us moving forward as there are not many bullets left in the monetary policy gun.

Below you can see a chart showing the spend that is outlined for the US in an effort to kick start their economy again.

This week’s article from the Financial Review give an overview of the economy and what is being done to keep the economy and the people in it, above water.

Stay safe, healthy and enjoy the read. Remember we are here and don’t hesitate to email or call at any time.

David and Team,

David

DJM

RBA rolls QE bazookas out

As I foreshadowed in my last column, the RBA has delivered precisely the optimal policy package for combatting the worst demand-side crisis since the Second World War. This includes:

- Cutting its target cash rate to 0.25 per cent to encourage banks to further drop borrowing rates for businesses and households, which they will do (watch out for very cheap fixed-rate loans);

- Commencing purchases of Australian government bonds to maintain a 3 year government bond yield of only 0.25 per cent, and to also support the liquidity of that market, which Governor Lowe said has become “impaired”. This will reduce the cost of longer-term, fixed-rate (as opposed to floating-rate) business and household loans that partly price off the 3 year government bond yield;

- Offering banks a longer-term funding facility of at least $90 billion on a 3 year basis at an ultra-cheap cost of just 0.25 per cent, which will enable all banks to provide very cheap finance to individuals and companies. This is a terrific idea that emulates the Bank of England’s approach;

- Working with the AOFM to launch an AOFM-managed $15 billion direct investment program in residential mortgage-backed securities (RMBS) and asset-backed securities (ABS). I have suggested at least $50 billion. This will further reduce the cost of borrowing for small business, households, and individuals via the AOFM funding highly rated and securitised pools of these assets at a cost, or spread, that is normalised. That is, not at current costs, which are enormously distorted by the virus-induced volatility. (I designed a similar $15 billion program for the government in 2008, and also the current $2bn program the AOFM is running to invest in securitised SME loans); and

- Continue to offer very cheap secured term funding to banks of up to 6 months or more at a cost of about 30 basis points (or 0.3 per cent) above the cash rate via the RBA’s existing repurchase (or repo) arrangements.

So this new QE package from the RBA and AOFM is unprecedented and very multi-faceted.

As a starting point, it is perfectly designed and a huge congratulations must go to the RBA, and Governor Phil Lowe and Deputy Governor Guy Debelle in particular, and to Treasurer Josh Frydenberg and Prime Minister Scott Morrison.

They have acted with speed and clarity to seek to thwart the unprecedented risks the nation faces, and embraced all the ideas I have previously outlined. What will be the impact? In short:

- Small business borrowing costs will decline by a large margin (I expect some major banks to drop SME rates by as much as 100bps);

- Medium and large sized business borrowing costs will drop sharply;

- Home loan repayment costs will fall;

- Personal loan and credit card costs will decline;

- Bigger banks will not have their net interest margins crushed by record-high wholesale funding costs;

- Smaller banks will be able to tap as much cheap money as they need, removing a key financial stability risk;

- Non-banks will be able to harness the RMBS/ABS markets for funding, saving their bacon and keeping pressure on the big banks;

- Overall bank and non-bank funding costs should fall markedly.

We now await the government’s fiscal package, which should be released on the weekend. This will likely involve huge cash stimulus direct to workers, those on the dole, and myriad other forms of compensation to create an income, funding and Liquidity Bridge between now and when the virus dissipates once anti-viral drugs are available and an eventual vaccine emerges.

I would also expect to see a special low or no cost lending scheme made available via the banks to businesses that want to tap emergency funding for a period of time, and then repay it over a number of years.

A huge win for Team Australia, led by the PM, Treasurer, RBA and AOFM. And the banks deserve a pat on their increasingly skinny behinds for doing their bit too!

By Chris Joyce

The views expressed in the above article are those of the author and should not be deemed as advice. You should always seek advice before making any significant final decision.